Reviews

How Corporate Investigations Safeguard Shareholder Rights

The importance of robust and proactive internal controls for companies cannot be overstated. Corporate investigations act as a vital checkpoint—one that companies rely on to detect, deter, and address activities that could harm shareholders or the organization’s reputation. Whether triggered by internal whistleblowing, regulatory actions, or routine audits, these inquiries are becoming increasingly crucial as corporate environments expand and their operations grow more global and interconnected. For shareholders, the value of such investigations lies in transparency and accountability, both of which are cornerstones of sustainable business practice. In particular, data breach investigations illustrate how addressing internal crises proactively can prevent costly damage to both finances and reputation.

When companies conduct investigations into potential wrongdoing—ranging from financial misstatements to compliance breaches—they not only fulfill their fiduciary duties but also signal to investors that ethical management is a priority. Tracing concerns early through these processes can avert scandals, regulatory penalties, and share price volatility. Additionally, such diligence can reassure regulators and the investing public that proper oversight mechanisms are in place, thus protecting shareholder value in the long run.

A clear commitment to looking into misconduct or inefficiencies within an organization demonstrates corporate maturity. This approach also lays the groundwork for companies to respond with corrective actions, fortifying their defense against future risks. As cyberattacks and compliance demands continue to rise, particularly among companies handling sensitive data, internal investigations become increasingly pertinent for organizations seeking resilience and strong investor relations.

In addition to internal investigations, firms should stay informed about broader governance trends and standards. Insights from Harvard Business Review on board governance emphasize the growing expectation for boards to actively monitor risk and drive transparency actively, reinforcing the value of comprehensive corporate investigations.

The Importance of Corporate Investigations

For shareholders, the primary benefit of corporate investigations is their ability to identify discrepancies and mitigate risks before they escalate into public crises. Regular reviews safeguard the accuracy of financial reporting, assuring investors that management is acting prudently and with integrity. These efforts directly address the fiduciary responsibilities companies owe their shareholders and position organizations to act quickly in the face of potential crises.

Corporate investigations also contribute to a culture of accountability. By signaling that the company will respond decisively to unethical behavior or inefficiencies, management demonstrates its commitment to upholding the interests of investors and other stakeholders. This aligns with findings from The Wall Street Journal, which emphasize how effective oversight can prevent damaging consequences and reinforce corporate integrity.

Conducting Effective Internal Investigations

The efficacy of an internal investigation depends largely on its structure and impartiality. Crucial elements include:

- Introducing a standardized and well-communicated process for initiating and managing investigations, which sets expectations for all involved.

- Ensuring the investigators are independent and not subject to internal pressures or conflicts of interest, thereby preserving objectivity.

- Maintaining confidentiality throughout the investigation process protects sensitive information and shields involved parties from undue reputational harm.

Adhering to these principles not only ensures a fair and comprehensive outcome but also signals to shareholders and regulators that the company takes its oversight and compliance obligations seriously.

Legal Considerations and Privilege

Companies must tread carefully when sharing findings from internal investigations. Legal privilege—protecting sensitive legal communications from disclosure—can be inadvertently waived if findings are inadequately managed or broadly shared. Organizations should provide concise, high-level summaries to satisfy transparency while protecting more sensitive details under the attorney-client privilege or work-product doctrine. As highlighted in legal commentary, the division between transparency and confidentiality is fraught with risk. Failing to observe privilege requirements can expose firms to legal liabilities or regulatory challenges, making it essential for lawyers to participate from the beginning.

Executives and board members must also understand reporting obligations, both internally and to external authorities, as laws may require disclosure of certain violations or findings. These requirements can vary significantly by jurisdiction, underlining the need for expert guidance in handling investigative outcomes.

Enhancing Corporate Governance

Corporate investigations catalyze stronger corporate governance by identifying shortcomings in management oversight or procedural weaknesses. When organizations adopt continuous improvement through regular audits and investigations, they not only resolve emerging problems but also establish a culture of accountability and ethics from the top down.

Furthermore, transparent findings and responsive action plans can enhance a company’s standing with institutional investors and regulatory bodies. By implementing recommendations from investigative findings—ranging from updated controls to personnel changes or revised reporting protocols—organizations strengthen their resilience and foster a climate of trust.

Conclusion

Corporate investigations represent more than just a risk management tool; they are essential mechanisms for upholding shareholder rights and preserving long-term corporate value. By fostering a culture of transparency, ethical leadership, and robust oversight, these investigations provide a powerful line of defense against misconduct and financial loss. As global business risks continue to evolve, companies committed to diligent investigations are best positioned to protect both their reputations and their investors.

-

Health3 days ago

Health3 days agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

Health5 days ago

Health5 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

US News1 week ago

US News1 week agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Legal6 days ago

Legal6 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

US News5 days ago

US News5 days agoFire breaks out at Raleigh Convention Center in North Carolina

-

Entertainment3 days ago

Entertainment3 days agoJoey Valence & Brae criticize DHS over unauthorized use of their music

-

Health1 week ago

Health1 week agoMarburg outbreak in Ethiopia rises to 12 cases and 8 deaths

-

US News1 week ago

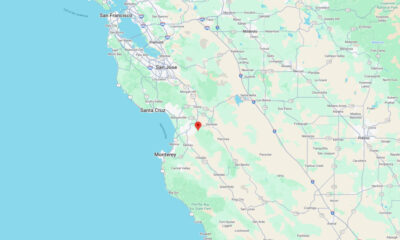

US News1 week agoEarthquakes rattle area between Salinas and Hollister, California