Reviews

How to Create Your Own Paystubs for Recordkeeping

Successful financial management requires you to track your spending against your budget. The paystub plays an important role here; it is a summary of your earnings along with the deductions. For those who want to maintain a detailed record, personal pay stubs can be a good option. In this article, we will explain the process of creating a paystub and discuss its benefits.

Understanding the Importance of Paystubs

Paystubs provide an in-depth view of income, taxes, and other deductions. They can be used as proof of income for loan applications and rent agreements. Additionally, people can monitor their financial status with pay stubs and ensure transparency in personal bookkeeping.

Gather Necessary Information

Before you create your own paystubs, you need to collect information such as the name, address, and identification number of the employee. This also includes data related to the employer, such as the name of the company or organization, its address, etc. You should also compile accurate information regarding income—including hourly rates or salary—plus any deductions, taxes, or benefits.

Choose a Paystub Template

You can find a variety of templates online to make it easier to create a paystub. Most templates include fields for earnings, taxes, and various deductions. Choosing a suitable template that matches your requirements can help you save time and ensure consistency. It is necessary to select one that complies with the local compliance requirements, so there are no discrepancies.

Input Earnings Information

The earnings section of the paystub is where both pay and wage details are addressed. It lists the hours worked and the hourly rate for hourly employees. Those who are paid a salary may have their monthly or annual salary noted. This should also include any bonuses or commissions.

Calculate Deductions

Deductions, which reflect taxes or other withholdings, make up a large portion of pay stubs. For example, these can be federal and state income tax, social security, and Medicare. This could include health insurance premiums or retirement contributions. It is crucial to calculate these as accurately as possible to make sure the net profit is calculated correctly.

Include Employer Contributions

Employers’ contributions should also be shown on the paystub. This could include contributions to a retirement plan or premiums for health insurance that the employer pays. Adding this information presents an overall perspective on the employer-employee financial relationship.

Review and Verify Information

When everything is entered, make sure to double-check the information to make sure it is accurate. Go through each subsection and make sure every line contains the correct numbers for earnings, deductions, and contributions. This ensures you avoid the possibility of mistakes that could cause misinterpretation or financial problems.

Save and Distribute Paystubs

Once the paystub is created and validated, the next step is to save it securely. Digital versions can be stored on personal devices or in cloud storage for access. Also, issuing copies to employees or other parties ensures transparency and aligns with legal requirements.

Utilize Paystub Software

If you want to automate the process, online paystub software can be useful. These will typically come with templates as well as fully automated calculations. This software ensures accuracy and efficiency in recordkeeping.

Benefits of Creating Personal Paystubs

There are many benefits of generating personal pay stubs. It provides a straightforward financial snapshot, helping individuals use it for budgeting and planning purposes. In addition, having extensive records can also facilitate tax planning while avoiding inconsistencies in reporting income.

Conclusion

Making personal pay stubs is a useful practice for anyone who wants to keep track of their finances with great precision and accuracy. By following these steps, you can create accurate and reliable paystubs with the correct income and deductions. Not only does this strengthen personal responsibility, but it also provides you with knowledge when financial questions or needs come up. Having your accounts straight ultimately helps you manage your finances better.

-

World1 week ago

World1 week agoEthiopian volcano erupts for first time in thousands of years

-

Legal5 days ago

Legal5 days agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News4 days ago

US News4 days agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

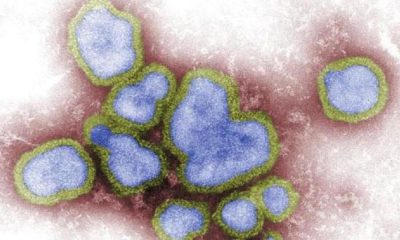

Health5 days ago

Health5 days agoMexico’s September human bird flu case confirmed as H5N2

-

Legal1 day ago

Legal1 day ago15 people shot, 4 killed, at birthday party in Stockton, California

-

World5 days ago

World5 days agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast

-

Health4 days ago

Health4 days agoMarburg outbreak in Ethiopia rises to 12 cases and 8 deaths

-

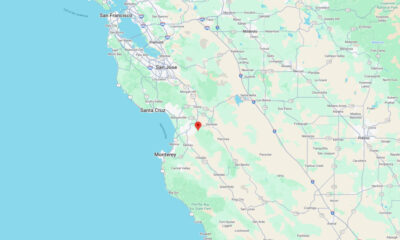

US News4 days ago

US News4 days agoEarthquakes rattle area between Salinas and Hollister, California