Reviews

Crypto and the American expat: Navigating US tax rules for digital assets overseas

Let’s face it – crypto is everywhere now. So are the people investing in it. No matter where you are – whether you’re holding Bitcoin in Berlin or staking Ethereum in Sydney – one thing doesn’t change: If you’re a US citizen, the IRS wants to know about it.

Crypto may feel borderless, but US tax rules definitely aren’t. The IRS treats digital assets like any other type of property. That means it’s taxable. Yes, even if you live abroad.

So, if you’re trading coins, mining tokens, or earning interest on a crypto platform overseas, you have some tax homework to do. The good news? We’re breaking down everything you need to know about United States expat taxes in plain English.

Still living abroad? You still owe US taxes on crypto

Here’s the deal: The US is one of the few countries that taxes its citizens no matter where they live. So, if you’re in Tokyo, Tel Aviv, or Tulum, your crypto gains still fall under US expat taxes.

The IRS doesn’t care:

- where your crypto exchange is based.

- or what your local country’s tax laws say.

- or whether you’ve “cashed out.”

If you’ve sold, swapped, earned, or spent cryptocurrency, you need to report it on your US tax return.

What if you’re holding crypto in a foreign wallet or on a non-US platform? You might also need to file extra forms, such as the FBAR or FATCA. More on that later.

Skip reporting? That’s where the trouble starts – think penalties, back taxes, and audits.

The IRS sees crypto as property, not currency.

Many people make a common mistake here: Crypto isn’t treated like dollars or euros. It’s taxed like property.

That means every time you:

- sell a coin

- Trade one token for another

- Use crypto to buy something

…it triggers a taxable event.

For example:

- You bought Bitcoin for $10,000.

- and later sold it for $15,000.

- You now have a $5,000 capital gain.

What if you held that Bitcoin for less than a year? Then that gain is taxed like your salary (short-term rate). If you held it for over a year? You get a better deal with long-term capital gains rates.

Even crypto-to-crypto trades count. Swap Ethereum for Solana? In the eyes of the IRS, that’s a sale.

Getting paid in crypto? It’s still income!

Not every move in the crypto world is about trading. Sometimes, you earn it through mining, staking, or receiving tokens for your work.

Here’s the catch: If you earn crypto, it counts as income.

And yes, the IRS wants you to report it.

- Mined 0.5 BTC when Bitcoin was at $30,000? That’s $15,000 in income.

- Received 10 ETH for freelance work? Report its market value on the day you received it.

- Did you earn staking rewards in ADA or SOL? They’re taxable. Every time.

This isn’t capital gains; it’s ordinary income. Report it on your Form 1040, just as you would with regular wages.

If you’re living and working abroad, though, some of this income might qualify for the Foreign Earned Income Exclusion (FEIE). However, be aware that even if the income is excluded from taxes, you still have to report it.

Foreign wallet? That might trigger extra reporting.

Some expats think, “I haven’t sold my crypto, so I’m good, right?”

Not exactly.

Even if you never trade a single token, holding crypto in a foreign account may require you to fill out additional forms.

- FBAR (FinCEN Form 114): You must file this form if the total value of your foreign accounts (including crypto custodial accounts) exceeds $10,000 at any time during the year.

- FATCA (Form 8938): You must file this form if your foreign financial assets exceed $200,000 (for single filers) or $400,000 (for joint filers) at the end of the year – or at any point during the year.

And the penalties? They’re not small. Forgetting to file FATCA can cost up to $10,000 per violation. What about FBAR? Even more.

So, if you hold crypto on platforms like Binance, KuCoin, or Bitstamp – especially outside the US – it’s time to double-check whether you need to report it.

The takeaway? Crypto abroad isn’t a loophole. If you don’t handle it right, it’s a reporting risk.

Global crypto rules are coming – and they’re serious

The days of flying under the radar with foreign cryptocurrency accounts are coming to an end. Fast.

Here’s what’s rolling out:

- CARF (Crypto-Asset Reporting Framework): A global initiative from the OECD. It will force crypto exchanges to share your data with tax agencies, much like banks already do.

- DAC8 (EU Crypto Reporting Directive): Europe’s version of CARF. Even if you’re not in the EU, your data could still be shared.

- Form 1099-DA: Starting in 2025, US-based platforms will send this form to the IRS (and to you), reporting all your digital asset transactions.

So, if you thought you could skip reporting because the IRS wouldn’t know, think again. These tools are designed to close those gaps.

Crypto tax pitfalls expats should avoid (and what a CPA would tell you)

Let’s be honest – crypto taxes are tricky. For expats, they can be especially overwhelming.

Here are the top mistakes we see, and how to avoid them:

- “I didn’t sell anything, so I don’t owe any taxes.”

Not true. Trading one coin for another or spending crypto on a product or service is a taxable event. - “Staking and mining rewards are free coins.”

No. The IRS considers them income. You owe taxes on the value of the coins on the day you receive them. - “I don’t need to report unless I cash out.“

However, if you’re using a non-US exchange, your holdings may require FBAR or FATCA reporting, even if you haven’t made any transactions. - “I’ll check my transaction history later.“

That’s risky. Many platforms don’t keep full records forever. You should track your cost basis, sale dates, and values now instead of scrambling during tax season.

The good news is that you don’t have to figure this out alone. You don’t have to figure this out alone!

A CPA who understands both cryptocurrency and United States expat taxes can help you stay compliant and find opportunities to reduce your tax bill through exclusions, deductions, and smart reporting.

Taxes for Expats (TFX)

TFX has over 20 years of experience helping Americans abroad with US taxes, filing over 50,000 expat tax returns, including many involving cryptocurrency.

TFX promises clients they don’t have to worry about dealing with a robot or a faceless team, instead offering a dedicated CPA who understands the client’s situation and expat life and can clearly and calmly walk them through everything.

Whether you’re:

- mining in Malta

- holding long-term in Lisbon

- or actively trading in Tokyo

… ensure your crypto is reported correctly, your risks are managed, and your returns are optimized.

-

US News1 day ago

US News1 day agoJetBlue flight diverts to Tampa after altitude drop injures at least 15

-

US News1 week ago

US News1 week agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

World5 days ago

World5 days agoU.S. Navy helicopter and fighter jet crash in South China Sea; all crew rescued

-

Legal6 days ago

Legal6 days agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

US News2 days ago

US News2 days agoTrump says U.S. will resume nuclear weapons testing ‘on an equal basis’

-

US News3 days ago

US News3 days agoDamage reported in Kilgore, Texas following tornado warning

-

World5 days ago

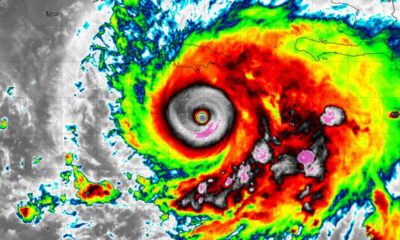

World5 days agoMelissa could make landfall in Jamaica as a Category 5 hurricane

-

Legal3 days ago

Legal3 days ago3 killed in murder-suicide involving Wright-Patterson Air Force Base personnel