Reviews

Smart Loan Management for Medical Students: 7 Tips to Save Money and Reduce Debt Over Time

For many medical students, student loans are a necessary part of the journey to becoming a healthcare professional. However, with the cost of medical school often resulting in six-figure debt, it’s essential to approach loan management with a strategy that can help reduce debt and save money in the long run. Below are seven practical tips designed to help you take control of your loans while focusing on your studies and career goals.

1. Explore Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are popular among medical graduates because they align your monthly payment with your income level. Rather than a fixed monthly amount, IDR plans calculate payments as a percentage of your income, typically around 10-15%. This can be especially helpful during residency, when your income may be lower than it will be later in your career.

Several IDR plans are available, such as PAYE (Pay As You Earn) and REPAYE (Revised Pay As You Earn), each with its own terms. Researching and selecting a plan that suits your current and expected future income can significantly ease financial pressure. For detailed information on these programs, the Federal Student Aid website offers a comprehensive breakdown.

2. Take Advantage of Loan Forgiveness Programs

The healthcare field provides unique opportunities for loan forgiveness for healthcare workers. Programs like the Public Service Loan Forgiveness (PSLF) are specifically designed for professionals in public service roles, including medical professionals working in nonprofit hospitals or government facilities. After 10 years of qualifying payments under a PSLF-approved repayment plan, your remaining loan balance can be forgiven.

Additionally, other loan forgiveness programs are available at the state level, often tied to working in underserved or rural areas. Researching these programs and understanding the qualifications can save you tens of thousands of dollars over time.

3. Consider Refinancing When Interest Rates Are Favorable

Refinancing involves taking out a new loan to pay off your existing loan, ideally at a lower interest rate. This option is particularly useful if you have high-interest federal or private loans. By refinancing medical student loans, you may secure a lower rate, which can significantly reduce the amount you pay in interest over the life of the loan.

However, refinancing is only advisable if you’re confident you won’t need the benefits of federal loan programs like income-driven repayment or PSLF. Private loans generally do not offer these benefits. If you decide to refinance, carefully compare lenders to find the best rate and terms.

4. Prioritize High-Interest Loans

When managing multiple loans, it can be tempting to pay a little extra on each one. However, focusing on paying off high-interest loans first can help you save more in the long run. This strategy, often referred to as the “avalanche method,” involves prioritizing loans with the highest interest rate while making minimum payments on the rest.

By reducing high-interest loans early, you limit the amount of interest that accrues over time, which translates to significant savings. Once the highest-interest loan is paid off, shift your focus to the next-highest interest-rate loan, and so on.

5. Set Up a Realistic Budget and Stick to It

Budgeting might not be a thrilling activity, but it’s one of the most effective tools for managing debt. Start by calculating your monthly expenses and allocating funds to essential categories, including your loan payments. By creating a budget and adhering to it, you ensure that loan payments are prioritized without compromising your daily needs.

Tracking your spending will reveal areas where you might be overspending, allowing you to make adjustments that free up additional funds for loan repayment. Budgeting apps like Mint or YNAB can simplify this process and keep you accountable.

6. Adopt Financial Habits to Maximize Loan Payments

Small lifestyle changes can add up to substantial savings. Avoiding unnecessary expenses, living within your means, and being mindful of day-to-day costs are habits that can make a significant difference. For instance, if possible, consider sharing living expenses with roommates or choosing affordable housing to reduce monthly costs.

Furthermore, direct any extra income — like bonuses, scholarships, or even birthday gifts — toward your loan payments. Every additional payment reduces your principal balance, which lowers the total interest you’ll pay over time.

7. Stay Updated on Loan Repayment Options and Resources

The student loan landscape is constantly evolving. By staying informed on the latest federal and private loan programs, interest rates, and policy changes, you can adjust your repayment strategy as needed. Government programs are periodically updated, and new legislation may introduce additional benefits or alternative repayment plans.

Regularly visiting trusted sources, like the Federal Student Aid website here, will ensure you have the latest information. Financial literacy workshops or student loan counseling services are also great resources, often provided by medical schools to help students make informed financial decisions.

Final Thoughts

Managing student loans as a medical student may seem overwhelming, but a proactive approach can help make it manageable and even save you money in the long run. From selecting the right repayment plan to making smart financial choices, each step you take now will benefit your future self. By using these seven strategies, you can focus more on your studies and career goals and less on financial stress, setting yourself up for a more stable financial future.

-

US News15 hours ago

US News15 hours agoJetBlue flight diverts to Tampa after altitude drop injures at least 15

-

US News6 days ago

US News6 days agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

World5 days ago

World5 days agoU.S. Navy helicopter and fighter jet crash in South China Sea; all crew rescued

-

Legal5 days ago

Legal5 days agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

World1 week ago

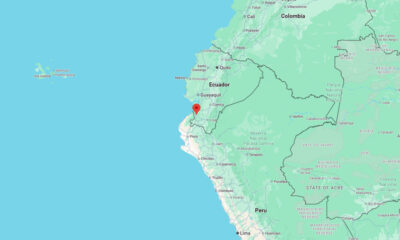

World1 week agoMagnitude 6.1 earthquake strikes Ecuador–Peru border region

-

World1 week ago

World1 week agoHurricane watch issued for Haiti due to Tropical Storm Melissa

-

US News1 day ago

US News1 day agoTrump says U.S. will resume nuclear weapons testing ‘on an equal basis’

-

US News3 days ago

US News3 days agoDamage reported in Kilgore, Texas following tornado warning