Reviews

U.S. Commercial Gaming Revenue Tops $51 Billion Through August, AGA Reports

America’s casino industry is on a historic run. According to the American Gaming Association (AGA), commercial gaming revenue reached $51.14 billion through August 2025, marking an 8.9% increase from the same period last year and the strongest start to any year on record.

In August alone, the industry pulled in $6.46 billion from traditional casino games, sports betting, and iGaming — a 14.6% jump year-over-year and the best August performance ever recorded. Every vertical contributed, from slot machines and table games to mobile sports betting platforms.

The figures were published this month in the AGA’s Commercial Gaming Revenue Tracker, which uses state regulatory data.

What’s Driving the Surge

The growth isn’t the result of a single boom. Traditional casinos reported $4.42 billion in revenue from slots and table games, up 5.7% compared to last year, while sports betting hit $1.12 billion — nearly 49% higher than in August 2024.

But the real star of 2025 is online gaming. The combined revenue from iGaming and online sports betting rose 41.3%, totaling $2 billion for the month. Individually, iGaming grew 31.3%, while online sports betting surged 43.7%. Together, online platforms now account for nearly one-third (30.8%) of total commercial gaming revenue.

For players, that means more choice — and more ways to engage. Platforms like Bonus Finder have noticed this trend early, tracking the migration of players between in-person and online play as bonuses and loyalty systems become more integrated.

Record Tax Contributions

The revenue boom isn’t just good news for operators — it’s also fueling record tax contributions. In August alone, gaming activity generated $1.47 billion in state gaming taxes. Over the first eight months of 2025, that figure reached $11.86 billion, giving lawmakers plenty to discuss as budget season approaches.

Some states are already debating how to allocate the windfall. Infrastructure, education, and social programs are top contenders, while regulators are also weighing new investments in responsible gaming research and addiction prevention.

Market Dynamics and Local Growth

Nearly every major commercial gaming jurisdiction saw an increase this year. Of the 37 jurisdictions active a year ago, all but one — Oklahoma — posted year-over-year growth. States like Illinois (+24.3%), Delaware (+31.0%), Virginia (+34.5%), and Nebraska (+43.8%) led the charge, the latter boosted by the opening of the new Lake Mac Casino & Resort in mid-August.

The combination of new venues, technology-driven engagement, and integrated entertainment options has kept the casino floor buzzing. Many resorts are expanding offerings beyond gaming — dining, live entertainment, and esports lounges — helping sustain growth even as operational costs rise.

The Bigger Picture

Analysts say the surge underscores how the gaming industry continues to evolve into a key economic engine. With $51.14 billion already banked by the end of summer, the sector is on track to break 2024’s full-year record by a wide margin.

The challenge now is sustaining that momentum responsibly. Regulators are urging transparency and compliance, operators are emphasizing safer play, and players are demanding fair, innovative experiences.

Financial analysts are cautious, though. They say this milestone is impressive, but not bulletproof. A few off months could send next year’s numbers sliding. The economy still dictates how far discretionary spending can stretch.

For now, 2025 is shaping up to be a landmark year. The billion-dollar months are stacking up, the online market is booming, and the tax revenue keeps climbing. The next question isn’t whether gaming can keep breaking records — it’s how high the next one will go.

-

World1 week ago

World1 week agoCargo plane plunges into sea at Hong Kong airport; 2 killed

-

Health1 week ago

Health1 week agoMexico reports new human case of H5 bird flu

-

US News4 days ago

US News4 days agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

World2 days ago

World2 days agoU.S. Navy helicopter and fighter jet crash in South China Sea; all crew rescued

-

Legal1 week ago

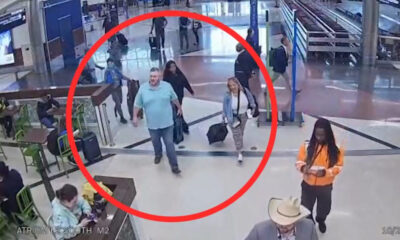

Legal1 week agoMan armed with AR-15 arrested after threats to ‘shoot up’ Atlanta airport

-

Legal3 days ago

Legal3 days agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

World1 week ago

World1 week agoMagnitude 5.0 earthquake rattles Dominican Republic

-

World7 days ago

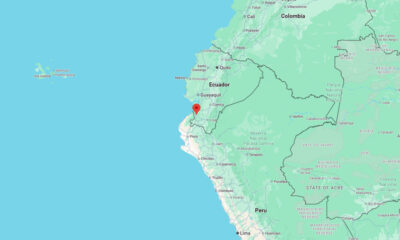

World7 days agoMagnitude 6.1 earthquake strikes Ecuador–Peru border region