Reviews

Stop Throwing Money Away on Car Insurance in Atlanta

You know that feeling when you get your insurance bill and just think… that can’t be right? Yeah, that happens to a lot of people in Atlanta. They’re paying way more than they need to, and honestly, most of them don’t even know it’s possible to pay less.

I ran into this problem myself a few years back. Got my renewal notice and the price had jumped up like thirty percent. Called around, got some quotes from other places, and found out I could get better coverage for almost half of what I was paying. Half! It made me wonder why I hadn’t bothered checking before. Turns out, a lot of Atlanta drivers are in the exact same boat.

What Actually Matters When Looking at Coverage

Georgia says you gotta have liability insurance. That’s the baseline. Period. But then there’s all this other stuff – collision, comprehensive, uninsured motorist coverage – and people get confused about what they actually need versus what some agent is trying to sell them.

If you’ve got a financed car, the bank won’t let you skip collision and comprehensive. They want to protect their investment. Makes sense from their side. But if you own the car outright? Maybe you don’t need a collision if the car’s old and worth next to nothing anyway. This is where thinking about it actually saves money instead of just going with whatever the form suggests.

Medical payments coverage is one people often skip but shouldn’t. You could get hit by someone else and their insurance won’t cover your medical bills if you got hurt. That’s what this is for. It’s not crazy expensive either. Same thing with uninsured motorist protection – you’d be shocked how many people drive around without real insurance in Atlanta.

The Quote Shopping Thing Really Does Work

This is the part where most people either don’t bother or give up too fast. Getting quotes from different companies takes maybe an hour total if you do it right, and I’m not exaggerating when I say it could save you five hundred bucks a year. Sometimes more.

Here’s what actually works: use the same details for every single quote. Same car, same coverage amounts, same deductible. Don’t change stuff around because then you’re not comparing apples to apples, and you’ll never know if Company A is actually cheaper or just quoting you different stuff. Put in your real info – age, driving record, how much you drive – and see what comes back.

One company will charge you $120 a month. Another will want $180. Different companies look at risk totally differently. Some love Atlanta drivers with clean records. Others have had bad experiences and price accordingly. It’s just how it works.

Those Discounts Actually Add Up

Insurance companies throw around discounts like crazy, but they don’t just volunteer them. You have to ask. Or in some cases, actually read through their website or the fine print in your quotes to spot them.

Bundle your car and home insurance? That’s usually 15 or 20 percent off right there. Good driver for several years? Another 10 percent. Took a defensive driving course? Some companies will give you something for that. Paid your policy in full instead of monthly? Could save a few bucks. These aren’t huge individually, but stack three or four of them together and suddenly you’re looking at real money.

I know someone who saved almost $40 a month just by bundling. That’s almost five hundred a year. She had no idea the discount was that big until she actually asked during the quote process.

Some places also have apps that watch your driving. Safe drivers get deals at the end of the month or quarter. If you’re the type who drives carefully and doesn’t go crazy with speeding or hard braking, that could actually be worth trying out.

The Deductible Squeeze

The deductible is what you pay when something happens before insurance covers the rest. Bump it up from five hundred to a thousand, and your monthly bill drops. But now if you get in an accident, you’re out a grand instead of five hundred.

This one’s personal. Someone with money saved up might not worry about a higher deductible. Someone living tight might need it lower just to sleep at night knowing they could actually afford it if they needed to. There’s no magic number that works for everyone.

The thing is, most people just accept whatever default the insurance company throws at them. Spend five minutes checking different deductible amounts and see how the price changes. It might surprise you what you find.

Atlanta Isn’t Like Everywhere Else

This city’s got traffic that’ll make your head spin. More cars on the road means more accidents, higher theft rates in some areas, just more risk all around. Someone living downtown pays different than someone out in the suburbs. Someone with an hour commute pays different than someone working remote.

These things matter to insurance companies. They’re not being random about it. But knowing it matters means understanding why your quote is what it is. Sometimes it’s worth it to make other living or work arrangements. Sometimes it’s not. At least if you know the impact going in, you can make a real decision instead of just being surprised.

Actually Getting the Quotes Is Pretty Easy Now

Gone are the days of calling a dozen agents and listening to a sales pitch from each one. You can get multiple quotes in like ten minutes now. Fill out basic stuff – name, driver’s license number, what car you drive, what coverage you want – and boom, quotes come back. Most places don’t even require a phone number if you don’t want them calling you.

When searching for car insurance quotes in Atlanta there are plenty of options to compare, and you can do it all without talking to a single person if you don’t feel like it. See what the options actually are, compare them side by side, and then pick up the phone if something looks good.

Don’t Just Set It and Forget It

Insurance doesn’t have to be that thing you sign up for and never think about again. Every year or two, it’s worth doing some checking. Rates change, new discounts pop up, and sometimes a completely different company becomes the best deal.

Some people find a place they like and stick with it forever. That’s fine if the price makes sense. But plenty of people are still overpaying because they never bothered to look around. It takes maybe an hour every couple years to potentially save hundreds. Do the math on whether that’s worth your time.

Why This Matters

Insurance costs keep going up. That’s just reality. So getting a better rate now isn’t about being cheap – it’s about not bleeding money for something that’s already mandatory. That savings can go toward actually fixing your car when something breaks, building an emergency fund, or just having a little breathing room in your actual budget.

Finding something decent doesn’t require any special knowledge. Just look around a bit, understand what coverage actually makes sense for your situation, and don’t feel weird about switching if someone else has a better price. That’s literally what the insurance market is designed for.

-

US News21 hours ago

US News21 hours agoJetBlue flight diverts to Tampa after altitude drop injures at least 15

-

US News7 days ago

US News7 days agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

World5 days ago

World5 days agoU.S. Navy helicopter and fighter jet crash in South China Sea; all crew rescued

-

Legal6 days ago

Legal6 days agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

World1 week ago

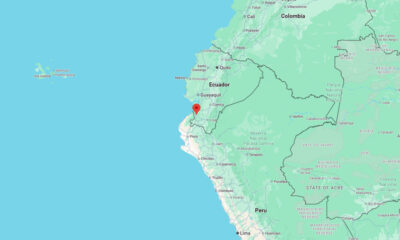

World1 week agoMagnitude 6.1 earthquake strikes Ecuador–Peru border region

-

World1 week ago

World1 week agoHurricane watch issued for Haiti due to Tropical Storm Melissa

-

US News2 days ago

US News2 days agoTrump says U.S. will resume nuclear weapons testing ‘on an equal basis’

-

US News3 days ago

US News3 days agoDamage reported in Kilgore, Texas following tornado warning