Reviews

How Strong Treasury Management Supports Business Growth

Here’s a scenario that’s familiar to many business owners: Your operations are expanding, and revenue looks great, but cash flow has become unpredictable. Worse? Your financial processes are getting harder to manage.

Growth doesn’t just increase profits; it multiplies your business’ moving parts. But that’s where treasury management comes in. For mid-sized businesses, treasury management – the strategies a company puts in place to oversee cash flow, funding, and risk – is what turns financial activity into financial strategy, laying the groundwork for sustainable growth.

Using treasury management to grow your business

Treasury management is about managing your business’ financial resources so you can achieve your goals. In practice, that might include:

- Ensuring you have sufficient funds to meet your daily operational needs.

- Mitigating risks, such as foreign exchange rate volatility and interest rate fluctuations, to strengthen stability.

- Evaluating capital-raising options, like offering equity and issuing bonds, to fund growth while minimizing risk.

- Assessing investment opportunities for your surplus funds to optimize returns.

- Establishing policies for financial reporting, regulatory requirements, and compliance that may enhance credibility.

Each of these tasks contributes to your business’ financial health. But when you look at your finances through a treasury management lens, you’re also gaining insights, improving efficiency, and building stability – all of which set the stage for your next phase of growth.

Visibility that fuels smart decisions

Whether you’re expanding to a new location, launching a new product, or adding to your team, good decisions start with clear insights. Treasury management helps provide that visibility by centralizing your view of your cash and accounts and improving your ability to forecast cash flow. With that knowledge in hand, you can reinvest in your business with confidence.

Efficiency that scales with you

Putting treasury management systems in place can help you automate payments, collections, and reconciliations. That not only lowers your costs and minimizes the risk of errors, but it also frees up time your team can use to focus on strategy.

Stability that earns confidence

Treasury management plays a central role in building structures that strengthen financial stability and reduce risk. For example, that could involve creating systems to monitor changing interest rates or implementing internal controls to guard against fraud. By minimizing uncertainty, treasury management helps position your business for long-term financial resilience.

How to know if your business has reached the tipping point

Mid-sized businesses often reach a stage where their financial activities have outgrown basic banking tools. At the same time, they’re seldom large enough to justify a whole treasury department. Treasury management services, typically provided by your bank, can bridge that gap.

You may be ready to level up if:

- You’re spending too much time on manual processes.

- You have multiple accounts with various financial institutions and lenders.

- You’re experiencing friction from delayed payments or rising transaction volumes.

- Your investors or lenders expect more financial sophistication.

- You’re managing transactions in foreign currencies.

- You’re facing seasonal cash flow challenges.

Even if you’re not ready to hire a treasury manager, adopting treasury management services can help you streamline operations, strengthen financial control, and prepare your business for growth.

Building treasury capabilities step by step

Implementing treasury management strategies isn’t just a matter of choosing a platform for your business. If you jump straight to technology, you risk paying for services that don’t fit your business needs.

Instead, start by assessing your current processes and pain points to identify where improvements will have the biggest impact. That usually means bringing in stakeholders from multiple departments, such as finance, operations, and accounting, to get a more complete picture of your goals and challenges. These stakeholders can help you define your objectives and evaluate potential solutions that align with your growth plan.

A key part of this process is establishing key performance indicators (KPIs) to track your progress over time. KPIs provide a measurable way to understand how effectively your treasury strategies support your business objectives.

Here are a few common KPIs used in treasury management:

- Cash conversion cycle (CCC): Measures how long it takes to convert inventory and other resources into sales; a shorter cycle indicates your business is performing well at recovering cash.

- Cash flow forecast accuracy: Tracks how closely your projected cash flow matches actual results, helping you assess the reliability of your forecasting models.

- Days sales outstanding (DSO): Reflects the average number of days it takes to collect payment after a sale; a lower DSO generally means faster cash collection.

- Days payable outstanding: Indicates the average number of days your company takes to pay its suppliers; a high DPO may strain supplier relationships, but a low DPO might mean your company could operate more efficiently.

You can establish KPIs for just about any factor you want to measure, from liquidity and funding to forecasting and risk exposure. The key is to select metrics that align with your business goals and revisit them regularly to ensure your treasury management strategies are delivering value.

Growth is easier when you can see what’s ahead.

Strong treasury management gives mid-sized businesses the clarity, control, and stability necessary to grow strategically. By assessing your business’ operations and goals and exploring professional solutions, you can build a solid foundation for growth.

-

US News21 hours ago

US News21 hours agoJetBlue flight diverts to Tampa after altitude drop injures at least 15

-

US News7 days ago

US News7 days agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

World5 days ago

World5 days agoU.S. Navy helicopter and fighter jet crash in South China Sea; all crew rescued

-

Legal6 days ago

Legal6 days agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

World1 week ago

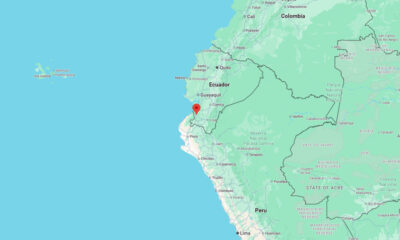

World1 week agoMagnitude 6.1 earthquake strikes Ecuador–Peru border region

-

World1 week ago

World1 week agoHurricane watch issued for Haiti due to Tropical Storm Melissa

-

US News2 days ago

US News2 days agoTrump says U.S. will resume nuclear weapons testing ‘on an equal basis’

-

US News3 days ago

US News3 days agoDamage reported in Kilgore, Texas following tornado warning