Reviews

Important Things to Know About Creating Effective and Legally Binding Financial Agreements

Nearly two-thirds of small businesses handle some form of financial agreement annually, whether through loans, investments, or vendor contracts. These agreements aren’t just about setting boundaries; they’re about building trust, offering protection, and making sure everyone knows exactly where they stand.

When handled correctly, they can streamline complex transactions and provide peace of mind. But when do you need one? And how can you ensure it’s legally binding?

When Do I Need Financial Agreements?

Financial agreements aren’t just about setting boundaries; they’re about building trust, offering protection, and ensuring everyone involved knows exactly where they stand. In general, there are 5 main situations where you might need to set up financial agreements.

First of all, lending or borrowing money. Whether you’re handing out a personal loan or taking on borrowed funds, a financial agreement like a promissory note lays out the repayment terms clearly. In fact, 70% of personal loans are formalized with a promissory note to avoid misunderstandings.

Secondly, investing in a business. Investors typically need to put together an investment agreement to spell out how their capital will be used and what returns they can look forward to.

You may need financial agreements when forming business partnerships, as a partnership agreement ensures all partners agree on the terms of collaboration and profit-sharing.

Also, financial agreements come in handy when dealing with vendor contracts as businesses often need financial agreements when entering into contracts with vendors for goods and services.

Last but not least, these agreements are needed when managing real estate transactions. Agreements like mortgage contracts or lease agreements are crucial in real estate dealings.

What Happens with Financial Agreements in 2024?

Managing financial agreements in 2024 has never been easier, thanks to significant advancements in technology and regulatory frameworks.

Nearly 80% of small businesses now use digital signatures to authenticate documents, enabling secure and quick electronic sign-offs that eliminate the need for cumbersome physical paperwork. For example, platforms like Lawrina Sign have made it simple for businesses to finalize deals in minutes rather than days.

Blockchain technology takes this a step further by offering tamper-proof, decentralized storage and verification. This ensures that agreements are not only secure but also transparent. Companies like IBM and Microsoft have already integrated blockchain solutions into their financial operations, providing a higher level of trust and reliability.

Smart contracts are also gaining traction. They automatically execute actions once predefined conditions are met, cutting out intermediaries and reducing costs. For instance, major banks are using smart contracts to automate loan disbursals, significantly speeding up the process.

Mobile and cloud-based solutions allow users to manage agreements from anywhere, anytime. According to a recent survey, over 60% of financial service providers now use cloud storage to back up documents securely and make them easily accessible, streamlining record-keeping.

Legal frameworks are catching up with these advancements, ensuring that digital and automated agreements are compliant and enforceable. Staying updated with these technologies not only smooths out the management process but also keeps you ahead in financial innovation.

In summary, managing financial agreements in 2024 is streamlined, secure, and more accessible than ever, leveraging the latest technologies and regulatory updates to set new standards for efficiency and reliability.

What Will Make Your Financial Agreement Legally Binding?

To make sure your financial agreement holds up in court, it’s crucial to meet all legal requirements. First off, compliance with laws is a must. This means your agreement has to stick to both state and federal regulations.

For example, if you’re putting together a loan agreement in California, you’ll need to watch out for specific interest rate caps and other local laws that govern lending.

Next, don’t overlook the importance of notarization and witnesses. Depending on the nature of your agreement, you might need to get the document notarized or have it witnessed.

Lastly, impeccable record-keeping is a must. Maintaining thorough documentation and adhering to record-keeping standards can save you a world of trouble later. Keep both physical and digital copies of the signed agreement.

For example, store a scanned version in a secure cloud storage service and a hard copy in a fireproof safe. Such diligence ensures you have proof of the agreement’s terms and conditions, making it easier to enforce if issues arise.

The Most Overlooked Financial Document

One of the most overlooked yet incredibly vital documents in financial agreements is the promissory note, which is essentially a written promise to pay back a loan under specified terms. Many people don’t realize just how powerful this simple document can turn out to be.

So, what makes a promissory note so essential? First, it clearly spells out the lending terms — the loan amount, interest rate, repayment schedule, and any late fees.

Let’s say you’re lending $10,000 to a friend who promises to repay it within five years at a 5% interest rate. All these details should be concisely stated in the promissory note. This way, there’s no ambiguity about what was agreed upon.

But what if you’re worried about default? The beauty of a promissory note is that it can include collateral requirements or specify what happens in case of a default. If your friend pledges their car as security for the loan, this adds a layer of protection for you.

By putting together a well-crafted promissory note template, you lay the groundwork for a clear, enforceable financial agreement. It clears up any misunderstandings, safeguards all parties involved, and sets up a legal framework that can hold up in court if needed.

-

Health1 week ago

Health1 week agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

US News6 days ago

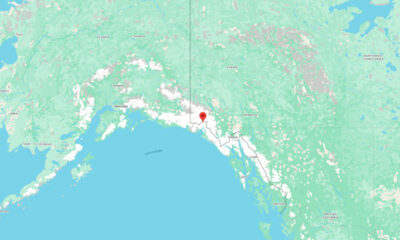

US News6 days agoMagnitude 7.0 earthquake strikes near Alaska–Canada border

-

Entertainment1 week ago

Entertainment1 week agoJoey Valence & Brae criticize DHS over unauthorized use of their music

-

Legal3 days ago

Legal3 days agoShooting at Kentucky State University leaves 1 dead and another critically injured

-

Business2 days ago

Business2 days agoUnpublished TIME cover suggests AI leaders may be named Person of the Year

-

Legal1 week ago

Legal1 week agoWoman detained after firing gun outside Los Angeles County Museum of Art

-

Entertainment1 week ago

Entertainment1 week agoSeveral countries withdraw from 2026 Eurovision after Israel is allowed to participate

-

US News1 week ago

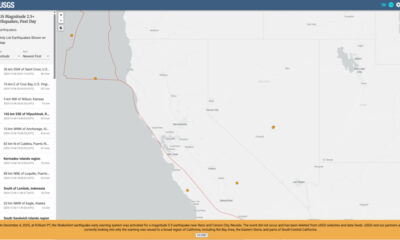

US News1 week agoErroneous earthquake warning triggers alerts across California