Reviews

Bitcoin’s Surge in Media Coverage: What the Latest Trends Reveal

Bitcoin is the headline of nearly every medium; it is a sign of its increasing relevance in global financial markets. As September 2024 began, changes were happening very quickly in the crypto market, and Bitcoin captured the greater majority of that attention from news outlets and financial analysts alike. The ability to sell Bitcoin online through platforms like Moonpay has further contributed to its rise in popularity, offering users a safe and simple way to trade the cryptocurrency amidst these market changes. What follows is a discussion of the latest directions in Bitcoin reporting, along with the analysis of precisely how price action within the cryptocurrency is driving media storylines and helping to frame the overall financial conversation.

Bitcoin Price Today: A Snapshot of Current Trends

Today, the Bitcoin price today is approximately $27,500, representing a steep increase from the past month. It gained this value based on recent market fluctuations and institutional interest development after it again became a hot topic in media publications. According to data provided by Binance, Bitcoin surged as high as 15% within the month it spent, indicating a regained period of investor confidence and stability in that digital market.

The Role of Bitcoin in Financial News Coverage

News reports in recent times have shown that Bitcoin tends to star in financial headlines. The reports go well beyond what would be considered regular finance outlets. In the study by BNO News done recently, it was found that more than 25 percent of stories that were leading financial news sections were related to Bitcoin. The shift epitomizes Bitcoin’s impact on the broader topography of finance and its relevance to a growing audience of investors and enthusiasts.

Key Drivers Behind the Increased Media Focus

Other major causes for good media attention towards Bitcoin are the fact that, first, institutional adoption of Bitcoin has been on the rise and thus attracts a lot of interest. Huge financial giants like BlackRock and Fidelity, early this 2024 year, announced further extensions of their crypto offerings, hence driving Bitcoin coverage. Recently, the endorsement of Bitcoin ETFs in many major countries has driven media coverage even further.

Market Data and Media Narratives

Recent trends within Bitcoin do, in fact, prove that price fluctuations are correlated with media coverage. For instance, the price of Bitcoin reached $30,000 in August 2024, further compelled by frenetic media coverage on pace. According to CoinMarketCap, during this period, the number of news articles about Bitcoin went up 40%, reflecting the media interest in Bitcoin.

On the contrary, the slump in prices also attracts a lot of media attention. For example, in July 2024, due to the crash of Bitcoin down to US$ 22,000, news about Bitcoin jumped about 30% MoM. The same tendency reflects how sensitive media is regarding the volatility of Bitcoin prices: huge price fluctuations act as boosters.

The Influence of Media Coverage on Investor Behavior

Theoretically, media coverage forms investors’ perceptions and behaviors. In fact, studies conducted by PwC showed that about 65% of investors were based on media reporting in making their investment decisions to invest in Bitcoin. Therefore, it ensures the importance of accurate, timely media coverage in a bid to drive market sentiment and investment strategies.

Another poll by Reuters suggests that media coverage of news is a factor for 55% of cryptocurrency investors in making their decisions. Thus, the heightened attention that Bitcoin currently receives in financial news outlets could contribute to investor confidence and, therefore, changes in market dynamics that drive further price movements.

Looking Ahead: Future Trends in Bitcoin Media Coverage

As Bitcoin continues to evolve, so too will the depth and breadth of its media coverage. In this sense, nascent trends-for example, direct integrations of Bitcoin into a number of mainstream financial platforms and, more broadly, burgeoning interest in DeFi applications, are apt to guide future media narratives. More critically, improvement in still-developing regimes of regulation and technological advancement cannot be overlooked in how Bitcoin will be reported and discussed in the media. If anything, it manages only to limit and reiterate one thing: that Bitcoin has become increasingly important in the world’s financial markets. At a value of $27,500 today, the media reports on ups and downs within the markets and what those could really mean to the wider world. In this ever-evolving landscape, Bitcoin’s exposure through the media will continue to play a big role in investor attitudes and market sentiments.

Conclusion

News headlines featuring Bitcoin are indicative of its rise to importance across worldwide financial markets. Today, its price stands at $27,500 and lately, it undergoes wild swings. Due to this, Bitcoin will be red-hot in the conversations of financial analysts and will be featured in mainstream media. There is, in fact, some correlation between price movements in Bitcoin and its media narrative, underlining the effects this cryptocurrency has had on market sentiments and investor behavior. In this regard, further evolution will be witnessed through media outlets that set the stage for financial discussions and investment strategies. Understanding the market trends and how such trends have been represented in the media will go a long way to help investors and other stakeholders wade their way through the dynamic environment of cryptocurrency.

-

World1 day ago

World1 day agoCargo plane plunges into sea at Hong Kong airport; 2 killed

-

Business5 days ago

Business5 days agoYouTube restores service after widespread global outage

-

Health1 day ago

Health1 day agoMexico reports new human case of H5 bird flu

-

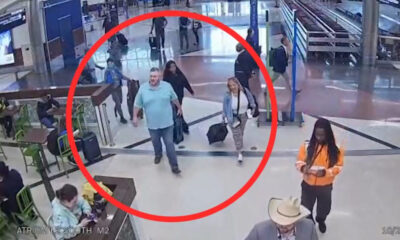

Legal7 hours ago

Legal7 hours agoMan armed with AR-15 arrested after threats to ‘shoot up’ Atlanta airport

-

World6 days ago

World6 days agoCar bomb explodes near shopping mall in Ecuador’s largest city

-

World4 days ago

World4 days agoEstonia permanently closes road through Russian territory

-

World4 days ago

World4 days agoU.S. Special Operations helicopters spotted near Venezuela

-

World9 hours ago

World9 hours agoMagnitude 5.0 earthquake rattles Dominican Republic