Reviews

Are We in a ‘Vibecession’? 5 Factors Financial Experts Believe Could Be Driving the Trend

The term “vibecession,” coined by economist Kyla Scanlon, describes the gap between the economy’s actual state and the public’s pessimistic perception of it. Essentially, it’s the feeling of a recession without the economic data to support it.

The Federal Reserve pointed to solid labor market indicators as proof that the U.S. was not in a recession. Despite this, consumer confidence has not fully returned to pre-pandemic levels, according to the University of Michigan’s Consumer Sentiment Index.

This puzzling trend, where consumer confidence remains low despite positive economic indicators, has led experts to explore several underlying factors.

Minimal Growth in Full-Time Employment

The job market may not be as robust as it appears. Recent reports have shown increased jobs, but much of this growth comes from part-time positions rather than full-time employment.

For the average worker, having to take on multiple jobs to maintain their standard of living does not inspire confidence in the economy. This lack of substantial full-time job growth leads to a more cautious and less optimistic outlook among the public.

The type of job growth is crucial to economic sentiment. While headlines may boast about job creation, the reality on the ground tells a different story. If people are piecing together incomes through multiple part-time jobs without benefits or job security, it undermines the perceived strength of the labor market.

This gap between job statistics and personal experiences significantly contributes to the vibecession. In response, many are turning to loans from a depository institution to make ends meet, further highlighting the instability in the job market.

Housing Market Trends

One potential cause of the current vibecession is the state of the housing market. Mortgage rates have reached their highest level in 20 years, climbing to 7% due to rate hikes. It has led to a dramatic drop in home inventory levels and a subsequent rise in home prices to record levels. These factors leave many people feeling stuck because they cannot move into new homes or purchase their first homes.

Experts believe that once inflation decreases further and the Fed cuts rates, mortgage rates will drop, potentially revitalizing the housing market and restoring consumer confidence. Until then, the housing market remains a significant source of public unease.

The ripple effects of the housing market are far-reaching. For many, buying a home is a significant milestone and an indicator of economic stability. When the housing market is inaccessible due to high prices and mortgage rates, it affects potential homeowners and the overall sentiment toward economic health. The dream of homeownership feels out of reach for many, fueling a broader sense of financial instability.

Geopolitical Tensions

Global uncertainty due to geopolitical tensions further contributes to economic unease. International conflicts and diplomatic strains can lead to market volatility, affecting consumer confidence.

These events can directly impact global markets and, by extension, the average consumer’s perception of economic stability. The interconnected global economy means geopolitical issues can quickly influence domestic sentiment.

Geopolitical tensions add a layer of unpredictability to the economic landscape. These events can disrupt markets and instill a sense of instability, whether it’s trade disputes, military conflicts, or diplomatic crises. For consumers already wary of economic conditions, geopolitical tensions reinforce fears about the future, making them more likely to save rather than spend, further dampening economic growth.

Negative Media Influence

The media’s portrayal of economic issues plays a significant role in shaping public sentiment. The political landscape has become increasingly polarized, with economic topics often depicted direly.

Americans are constantly exposed to doomsday scenarios from political leaders and the media. This constant stream of negative news contributes to a bleak outlook, regardless of economic conditions. Negativity sells, and the media’s focus on politics, war, and inflation exacerbates public anxiety.

The role of the media cannot be underestimated in forming public opinion. In a digital age where news is consumed around the clock, the relentless focus on negative stories creates a pervasive sense of doom. This media-driven pessimism can overshadow positive economic news, leading people to believe that things are worse than they are. The psychological impact of this negative bias is profound, shaping the collective mood and reinforcing the vibecession.

Lingering Sticker Shock

Another factor contributing to shaky consumer confidence is the lingering sticker shock from recent inflation spikes. Although the inflation rate has decreased from its peak two years ago, prices have not followed suit. Food prices remain significantly higher than three years ago, and gas prices have nearly doubled.

Minor fluctuations in inflation are irrelevant to the average consumer, who still feels the impact of past high inflation rates. The significant price increases during the height of inflation have left a lasting impression, contributing to ongoing consumer pessimism.

This persistent sticker shock is more than just an economic issue; it’s a psychological one. Consumers have grown accustomed to higher prices, making it difficult to feel optimistic even as inflation rates stabilize.

The memory of skyrocketing prices creates a lasting sense of financial strain, which continues to weigh on consumer confidence. This perception that prices will remain permanently high or continue to rise further dampens the overall economic outlook.

Final Thoughts

The economy may not be in a formal recession, but public perception remains cautious. Hence, staying informed and considering multiple perspectives on economic conditions is crucial to navigating these uncertain times. Understanding these contributing factors can help individuals manage their finances and maintain resilience.

-

US News3 days ago

US News3 days agoJetBlue flight diverts to Tampa after altitude drop injures at least 15

-

US News1 week ago

US News1 week agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

World7 days ago

World7 days agoU.S. Navy helicopter and fighter jet crash in South China Sea; all crew rescued

-

Legal1 week ago

Legal1 week agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

World17 hours ago

World17 hours ago10 people stabbed on train in Huntingdon, England

-

US News4 days ago

US News4 days agoTrump says U.S. will resume nuclear weapons testing ‘on an equal basis’

-

US News5 days ago

US News5 days agoDamage reported in Kilgore, Texas following tornado warning

-

World7 days ago

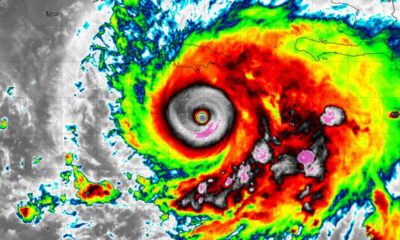

World7 days agoMelissa could make landfall in Jamaica as a Category 5 hurricane