Reviews

Global Regulatory Bodies Target Crypto Exchanges for Compliance Issues

Cryptocurrency exchanges have come under increased scrutiny from regulatory bodies worldwide, as governments and financial institutions grapple with the rapid growth of the digital asset market. As the cryptocurrency industry continues to evolve, issues such as money laundering, fraud, and inadequate consumer protection have prompted a coordinated effort by global regulatory authorities to enforce compliance measures on these exchanges. Below, we explore the growing regulatory challenges faced by crypto exchanges and the implications for the broader market.

The Rise of Cryptocurrency and Regulatory Challenges

The cryptocurrency market has grown exponentially in recent years, with the total market capitalization surpassing $2 trillion at its peak in 2021. Bitcoin, the first cryptocurrency, paved the way for thousands of alternative digital assets, traded across various exchanges and stored in crypto wallets such as the bestcryptowallet online. However, this explosive growth has brought significant challenges, particularly in regulation.

Cryptocurrencies are decentralized and often operate outside traditional financial systems, making it difficult for regulators to monitor and enforce compliance. Governments and financial authorities are now racing to establish regulatory frameworks to address concerns over illegal activities like money laundering, fraud, and tax evasion. For example, a report by Chainalysis highlights regions like Central and Southern Asia, where crypto use is high despite lower incomes

Global Regulatory Crackdown on Crypto Exchanges

In recent years, global regulatory bodies have stepped up efforts to hold cryptocurrency exchanges accountable for their operations. These exchanges, which facilitate the buying and selling of digital assets, have become the primary targets of regulators looking to impose stricter compliance measures. In particular, concerns over anti-money laundering (AML) and know-your-customer (KYC) protocols have driven much of this regulatory action.

In the United States, the Financial Crimes Enforcement Network (FinCEN) and the Securities and Exchange Commission (SEC) have been at the forefront of regulating crypto exchanges. These agencies have imposed fines and issued warnings to exchanges that fail to comply with existing AML and KYC requirements. In 2021, the SEC launched a probe into Coinbase, one of the largest cryptocurrency exchanges, regarding potential securities law violations. Similarly, Binance, the world’s largest exchange by trading volume, faced investigations from regulators in multiple countries, including the U.S., U.K., and Japan, for failing to meet compliance standards.

European and Asian Regulatory Responses

Europe has been proactive in tackling regulatory challenges for cryptocurrency exchanges. Under the European Union’s Fifth Anti-Money Laundering Directive (5AMLD), exchanges and wallet providers must follow strict AML and KYC rules, verifying user identities, reporting suspicious activities, and keeping detailed transaction records, with penalties for non-compliance.

The EU is also developing the Markets in Crypto-Assets (MiCA) regulation, aimed at standardizing crypto regulations across member states, focusing on consumer protection, transparency, and AML compliance.

In Asia, Japan leads with stringent regulations, requiring exchanges to register with the Financial Services Agency (FSA). South Korea enforces real-name verification through bank partnerships. In contrast, China banned cryptocurrency trading in 2021, citing concerns over financial stability and fraud, forcing major exchanges to relocate.

Compliance Issues and Exchange Repercussions

Regulatory pressure on cryptocurrency exchanges has resulted in several high-profile enforcement actions. In 2020, BitMEX was charged by the U.S. Commodity Futures Trading Commission (CFTC) for operating an unregistered platform and violating AML regulations, leading to criminal charges against its founders and a $100 million fine.

Similarly, Binance faced global scrutiny, including a 2021 order from the U.K.’s Financial Conduct Authority (FCA) to stop operations due to lack of authorization. Binance also halted its derivatives trading in Europe under regulatory pressure, reflecting broader shifts in exchange compliance.

Non-compliance can lead to severe consequences, including fines, bans, and the delisting of assets, reducing market liquidity. Some traders have shifted to decentralized exchanges (DEXs), though these platforms are also facing increasing regulatory challenges.

The Future of Crypto Exchange Regulation

As regulatory bodies continue to target cryptocurrency exchanges for compliance issues, the industry is likely to undergo significant changes. The introduction of clear regulatory frameworks could help stabilize the market and promote broader adoption of digital assets by providing investors with greater protection and transparency. However, the challenge lies in finding a balance between regulation and innovation.

Some industry stakeholders argue that excessive regulation could stifle innovation and push crypto trading into unregulated spaces, where it becomes harder to monitor. Others believe that robust regulation is necessary to prevent fraud and protect consumers. A 2021 survey by Deloitte revealed that 76% of financial services executives believe that regulatory uncertainty is the biggest obstacle to wider cryptocurrency adoption.

Crypto Exchanges Responding to Regulatory Pressure

In response to the growing regulatory scrutiny, many cryptocurrency exchanges have ramped up their compliance efforts. Coinbase, for instance, has increased its investments in compliance programs and hired former regulators to ensure that it meets global standards. The exchange has also pushed for more regulatory clarity in the U.S., advocating for the establishment of a single regulatory framework for digital assets.

Other exchanges have taken similar steps, with Binance announcing plans to strengthen its AML policies and reduce high-risk transactions. Kraken, another major exchange, has implemented more stringent KYC procedures and now requires all users to verify their identities before trading.

The rise in regulatory actions has also led to a surge in demand for RegTech (regulatory technology) solutions. Many exchanges are turning to automated compliance tools that use artificial intelligence and blockchain analytics to monitor transactions, flag suspicious activity, and ensure that they adhere to AML and KYC requirements.

-

World2 days ago

World2 days agoCargo plane plunges into sea at Hong Kong airport; 2 killed

-

Business6 days ago

Business6 days agoYouTube restores service after widespread global outage

-

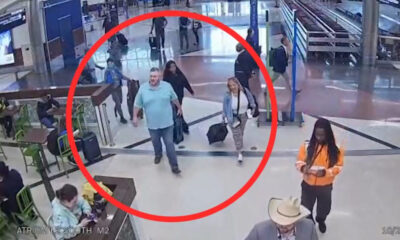

Legal16 hours ago

Legal16 hours agoMan armed with AR-15 arrested after threats to ‘shoot up’ Atlanta airport

-

Health2 days ago

Health2 days agoMexico reports new human case of H5 bird flu

-

World7 days ago

World7 days agoCar bomb explodes near shopping mall in Ecuador’s largest city

-

World4 days ago

World4 days agoEstonia permanently closes road through Russian territory

-

World18 hours ago

World18 hours agoMagnitude 5.0 earthquake rattles Dominican Republic

-

World5 days ago

World5 days agoU.S. Special Operations helicopters spotted near Venezuela