Reviews

Understanding Limited Partners (LPs) and General Partners (GPs) in Private Equity Fund

Have you ever wondered about how a private equity fund actually works? Then you are not alone. These types of investments are quite complex.

The real marvel is the synergy between its two main players, the Limited Partners (LPs) and the General Partners (GPs). To understand the in-depth working of what a private equity fund is and how it operates, we must understand the workings of the partners.

So, let’s read on to learn more about private equity and break down the responsibilities, dynamics, and impact of LPs and GPs.

What is a Private Equity Fund?

A private equity fund is essentially a pooled investment model. It directly invests in private companies. Or in certain cases it takes private ownership of public companies. There are firms that manage these funds. The private equity firms raise funds from various institutions. In a typical case, the private equity fund would focus on mature companies.

These companies are chosen based on certain factors. They often need restructuring, need to make improvements in their operations, or just need an influx of funds. The main aim of these investors is to improve the value of the company. This is so that they can sell it at a profit.

Private equity funds generally have a very structured framework in place. This structure is known as the private equity fund structure. Having a structure in place ensures that the funds are properly managed and that there is some form of accountability of the funds. This structure would also divide responsibilities and financial risks between the Limited Partners (LPs) and the General Partners (GPs). This would further ensure that each partner plays a specific role. Although their roles do get intertwined to ensure the private equity fund’s success.

Private Equity Fund Structure: The Basics

Private equity funds are often set up as limited partnerships. These are governed by a partnership agreement. They often have a proper structure of partners. Namely, limited partners (LPs) and general partners (GPs). This structure is not accidental; it ensures flexibility in operations. It also creates a clear separation of duties and liabilities. Here’s where LPs and GPs come into play.

The limited partners, as the name suggests, do not take part in the day-to-day management of things. These are mainly the investors who contribute capital to the private equity fund. This could include pension funds, insurance companies, endowments, or even high net worth individuals but they have limited liability. General partners on the other hand do more of the management part of things.

They usually contribute only a small portion of the money, but they usually have to be responsible for generating the returns. They also must do daily operations such as decisions regarding investments, managing the portfolio companies, and overseeing the exits. Additionally, the general partners would also charge the limited partners a management fee and a performance fee.

Now that we’ve outlined private equity, let’s dive deeper into the differences between LPs and GPs.

Key Differences Between Limited Partners and General Partners

Following are the key differences between the two:

1. Responsibilities and Roles

In private equity, Limited Partners (LPs) and General Partners (GPs) play very important roles. They have distinct yet complementary roles. LPs provide the capital that is required. They rarely participate in the daily operation. The GPs on the other hand are the active managers. They are responsible for every aspect of the fund’s operation, from sourcing deals and conducting due diligence to managing portfolio companies and orchestrating profitable exits.

2. Financial Contribution and Risk

Most of the money in a private equity fund is provided by the limited partners. However, their liability is limited to the amount they have committed to the fund. What this means is that LPs cannot lose any more than whatever they have invested in in the beginning. General partners on the other hand put in only maybe 1-5% of the money into the fund, but they are the risk takers. Since usually their payout is performance based, the fund has to perform well. Since GPs earn from the profits, their compensation could be unpredictable.

3. Compensation Structure

Although LPs would not lose any more money than invested, their profit depends on the fund’s performance. Once the GPs are compensated in the name of management fees and their share of carried interest rate, the rest goes to the LPs. So, all in all GPs have two ways of compensation.

4. Influence on Decision-Making

The limited partners tend to stay away from the decision making. They usually rely on the general partners for operating the funds. The GPs have full control of what to do with the funds. They can decide the investment strategy, portfolio management, and even the exit plans. The LPs however still have influence because they have voting powers.

How LPs and GPs Shape the Success of a Private Equity Fund

The interplay between LPs and GPs determines how smoothly a private equity fund operates and how successful it becomes. The LPs provide fuel. Without the capital contributions from LPs, the fund wouldn’t have the resources to make investments. And in a complementary partnership, the GPs steer the ship. The GPs’ skills in sourcing deals, driving value creation, and managing risks are what turn investments into profits.

The success of a private equity fund hinges on trust and alignment between these two parties. LPs trust GPs to act in their best interest rate, while GPs rely on LPs to provide the financial backing needed to execute their strategies.

Conclusion

It is important to know the roles of the limited partners (LPs) and the general partners (GPs). This will help you to understand a private equity fund better. Now we have understood that LPs provide the investment, the GPs decide where to invest in.

This partnership is what drives the growth of businesses. This dynamic is integral for generating wealth. So next time someone asks, “What is a private equity fund? you can confidently explain that it is not just about money. It is about the perfect partnership that comes together to synergize and build wealth.

By now you probably have a better understanding of private equity fund structure, and how it works. Are you inspired to learn more about it? Delve into the fascinating world of private equity fund and learn from its success.

-

World6 days ago

World6 days agoCargo plane plunges into sea at Hong Kong airport; 2 killed

-

US News1 day ago

US News1 day agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

Health6 days ago

Health6 days agoMexico reports new human case of H5 bird flu

-

Legal5 days ago

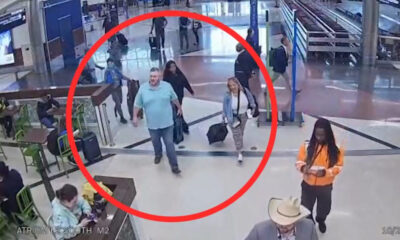

Legal5 days agoMan armed with AR-15 arrested after threats to ‘shoot up’ Atlanta airport

-

World5 days ago

World5 days agoMagnitude 5.0 earthquake rattles Dominican Republic

-

World1 week ago

World1 week agoEstonia permanently closes road through Russian territory

-

Breaking News5 hours ago

Breaking News5 hours agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

World1 week ago

World1 week agoU.S. Special Operations helicopters spotted near Venezuela