Business

The Future of Wealth Building: Why ULIP Plans Are More Than Just Insurance

When it comes to creating wealth in the future, available choices are numerous, and more often than not they are quite bewildering. Be it classic investment instruments or modern-day tools, every product is advertised as a tool for safe money creation. Now let us take a look at how ULIPs are gradually becoming the option of choice for people out there to build wealth and also understand what these plans beyond insurance have to offer.

What Is a ULIP Plan?

A Unit Linked Insurance Plan commonly referred to as ULIP is quite a complex and competitive financial product which offers insurance coverage and invests on behalf of the buyer. A ULIP plan offers the facilities of life coverage that you get when you buy a full insurance product and the rest of the money is pooled to invest in equities or debt depending upon your risk appetite.

Some of the Specifics Why ULIP Plans Are Best for Wealth Accumulation

- Insurance and investment go hand in hand to get the dual benefit out of the invested money.

Like the endowment plan, the ULIP plans combine features of life insurance and investment all in one plan.

- Flexibility in Investment Choices

Another benefit that has to do with ULIPs is flexibility. Thus, there is an option to select the type of fund to buy in equity, debt or an equal mix depending on your risk profile. For instance, if the market is good you might decide to invest in equity to get good returns on your investment. During turbulent periods, converting to debt funds could protect your wealth.

- Potential for High Returns

The investment portion of a ULIP is market-linked and ULIP is perfect for those who wish to accumulate wealth over time.

- Tax Benefits

ULIPs have many tax advantages that provide it as probably the best possible ways to accumulate wealth in the long run. You may claim tax exemptions under Section 80C of the Income Tax Act on the premium paid every financial year up to ₹1,50,000. Furthermore, the maturity benefits of a ULIP are tax-free under Section 10(10D) if the annual premium is less than 10% of the sum assured.

- Long-Term Investment Discipline

ULIPs generally come with a lock-in period of five years so as to foster long-term investor behaviour. This lock-in period ensures that people do not dive into their financial objectives in terms of investing by missing some good fortunes in the market due to fluctuations. Periodically the effect multiplies and thus, in the long run, amasses wealth that relieves one from monetary stress.

How a ULIP Calculator Enhances Investment Planning

ULIP calculator is an online tool which enables a person to know how much return he can get from his ULIP plan depending on the premium paid, duration of the policy and choice of funds. But with the feeding of such details, you get a better understanding of the possible sum at which your ULIP will stand once the stippled investment period has come to an end.

With this tool, you also get to find out the differences between different ULIP plans enabling you to make the right decisions concerning your financial goals/needs. Regardless of whether the need or dream is to build savings for your child’s education, a home in the future, or retirement, the ULIP calculator can offer useful information to kick-start the wealth accumulation process.

Analysing ULIPs with other Investment Schemes

ULIPs have some distinct advantages over other investment options like mutual funds or traditional endowment plans:

- Insurance Coverage: While Mutual funds do not offer life cover, ULIP offer life insurance which guarantees your family’s financial security.

- Switching Flexibility: ULIPs permit free fund exchanges hence providing for both insurance and fund versatility.

- Tax Efficiency: Being tax saving in both the stages of premium paying and maturity return ULIPs can be considered as tax-efficient investments.

For whom ULIPs is Most Suitable?

ULIPs are perfectly suited for anyone who needs life insurance coverage as well as wishes to invest to get more value added to their wealth. These plans are ideal for people who can make long-term investments and who are saving for specific objectives such as retirement, children’s education or to cater for a house among others.

But before investing in a ULIP plan, one needs to know their risk appetite. Since the returns on ULIP are market-related, the users with a low tolerance for risk may seek more exposure to the debt funds within the ULIP.

Conclusion

In the present era, investments are directly linked with ensuring and generating future finances, and ULIP plans are the universal solution. Tools like the ULIP calculator further simplify the decision-making process, helping investors choose plans that align with their goals.

-

Health6 days ago

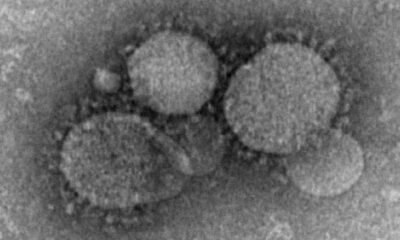

Health6 days agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

Health1 week ago

Health1 week ago8 kittens die of H5N1 bird flu in the Netherlands

-

US News4 days ago

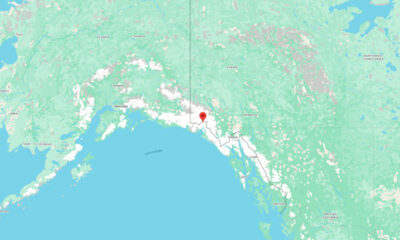

US News4 days agoMagnitude 7.0 earthquake strikes near Alaska–Canada border

-

Entertainment7 days ago

Entertainment7 days agoJoey Valence & Brae criticize DHS over unauthorized use of their music

-

Legal1 week ago

Legal1 week ago15 people shot, 4 killed, at birthday party in Stockton, California

-

US News1 week ago

US News1 week agoFire breaks out at Raleigh Convention Center in North Carolina

-

Legal6 days ago

Legal6 days agoWoman detained after firing gun outside Los Angeles County Museum of Art

-

Health1 week ago

Health1 week agoEthiopia reports new case in Marburg virus outbreak