Reviews

The Hunt is On: How to Find a Home You Love

Searching for how to find a home you love can feel like hunting for a needle in a haystack. With so many styles, neighborhoods, and price points, you might get stuck in analysis paralysis or settle for a place that misses the mark. What if you could streamline your search and use proven house hunting tips for buyers to find a home that matches your lifestyle, budget, and future goals?

In this guide, you will learn steps to finding your perfect home and cover topics such as:

- Defining your personal style to aid in choosing the right home for your lifestyle and finding your dream home

- Prioritizing must-have features versus nice-to-have perks

- Recognizing emotional factors in home buying and how to know if a house is right for you

- Avoiding buyer’s remorse when house hunting

- Getting financially ready with clear budgets and lender preapproval

- Future-proofing your choice for resale value and life changes

- Leveraging digital tools for efficient virtual and in-person tours

Ready to move from overwhelm to confidence? Let’s begin by defining your personal home style.

Define Your Personal Home Style

Crafting a vision for finding your dream home starts by defining personal style and aligning it with different property types and neighborhoods. Choosing the right home for your lifestyle depends on mapping design preferences to location. Start by exploring what appeals to you and why. This step also highlights what to look for when buying a house.

Décor and Architectural Style

Identify design elements that resonate with you:

- Aesthetic mood board

Clip photos from magazines or use Pinterest for interiors and exteriors you admire. - Style categories

Modern, mid-century, farmhouse, craftsman, industrial, or traditional. Note features like clean lines, natural textures, or ornamentation. - Color and material palette

Choose warm neutrals, bold accents, exposed brick, or wood finishes.

Urban vs. Suburban vs. Rural

Compare the pros and cons of each setting:

- Urban: High walkability, transit access, diverse dining, and entertainment options.

- Suburban: Larger lots, quality schools, a neighborhood feel, and quieter streets.

- Rural: Open space, privacy, and a slower pace.

Reflect on which environment suits your daily routine and social preferences. This is one of the key questions to ask yourself before buying a home.

Commute, Amenities, and Lifestyle Alignment

Match location to daily needs:

- Commute time: Use a mapping tool to estimate travel to work or school.

- Local amenities: Check proximity to grocery stores, parks, gyms, and healthcare.

- Lifestyle fit: Prioritize nearby trails for outdoor activity or nightlife if you thrive on city energy.

This step narrows your search to homes and neighborhoods that fit your life goals.

Prioritize Functional Needs and Layout

Before you tour properties, sort features into essentials and perks. This is one of the key steps to finding your perfect home. Use a simple ranking method to stay focused and avoid costly compromises later.

Must-Have vs. Nice-to-Have

Identify features you cannot compromise on:

- Home office or dedicated workspace with natural light

- Garage storage or mudroom for outdoor gear and tools

- Main-floor laundry if stairs are an issue

List perks that would be nice but not deal-breakers:

- Formal dining room

- Built-in bar or wine cellar

- Extra powder bath

Room-by-Room Considerations

- Kitchen: Check the work triangle, counter space, and pantry size.

- Living areas: Evaluate traffic flow and window placement.

- Bedrooms: Confirm closet dimensions and privacy.

- Bathrooms: Look for storage, efficient layout, and ventilation.

Adaptability for Future Needs

Plan for changing needs by choosing flexible layouts. Open-concept spaces can become a playroom or home gym. Bonus rooms above the garage or loft areas offer easy conversion. If you love cars, ensure your garage has room to display private plates and other memorabilia.

Consider features like wider doorways and zero-step entries for aging in place. Aiming for adaptability now can save on renovation costs later.

Recognize Emotional Traps and Avoid Buyer’s Remorse

When you tour homes, emotional factors in home buying can steer decisions. Recognizing common biases helps you avoid buyer’s remorse when house hunting. Use these strategies to stay grounded and reduce regrets down the line.

Staging Illusions

Professionals stage homes to evoke emotion with mood lighting, fresh flowers, or scented candles. Focus instead on layout, storage space, and the structural condition behind the decor.

Overbidding Under Pressure

Bidding wars trigger scarcity bias and herd behavior. You may overvalue a home when you imagine it as yours, a version of the endowment effect. Anchor your bid to recent comparable sales and set a strict maximum budget. Walk away if offers exceed that limit.

Using an Emotional Scorecard

A simple scorecard can restore objectivity. Your scorecard includes questions to ask yourself before buying a home.

Define Your Criteria

List your non-negotiable features and deal-breakers.

Assign Scores

Rate each home on layout, location, condition, and cost.

Review Scores Together

Compare scores across properties before emotions take over. This method highlights strengths and weaknesses based on facts.

Schedule breaks between tours to prevent burnout and analysis paralysis. By spotting emotional factors in home buying and relying on your scorecard, you can avoid rushed decisions and buyer’s remorse.

Get Financially Prepared

Before shopping for homes, you need clarity on what you can afford. This step is part of the essential steps to finding your perfect home. Break it into three parts: a budget worksheet, a review of hidden costs, and securing lender preapproval.

Budget Worksheet

Start by tracking income and monthly expenses. Aim for a mortgage payment below 25% of take-home pay. Build or maintain an emergency fund covering 3 to 6 months of living expenses. Plan for a 20% down payment to avoid private mortgage insurance. If you choose a lower down payment, include PMI premiums in your budget.

Upfront and Ongoing Costs

Review fees beyond your mortgage:

- Closing costs: set aside 3 to 4% of the purchase price

- Property taxes and insurance: adjust for local rates

- HOA dues and maintenance reserves: estimate annual costs

Factor these expenses into your monthly budget to avoid surprises.

Working with Lenders

Get prequalified to estimate your borrowing range early. Then get preapproval by submitting pay stubs, bank statements, and credit reports. For co-borrowers or guarantors, consider using smart background checks to verify credibility. A preapproval letter shows sellers you are a serious buyer. Ask about rate-lock windows and lender fees so you can compare offers with confidence.

Future-Proof Your Choice

As you choose a home today, consider long-term goals and market changes. This outlook helps you build equity and avoid costly adjustments later.

Growth and Resale Value

Plan for family changes and building equity. Aim for a 20% down payment to avoid PMI and keep your mortgage below 25% of take-home pay. A solid floor plan and good location will appeal to future buyers more than cosmetic upgrades.

Community and School Considerations

Homes in top-rated school zones often appreciate faster. Visit the area at different times to observe schools, parks, shops, and transit stops. Check local school ratings and follow neighborhood trends.

Exit Strategy

Define when and how you might sell. Consider career moves or remote work trends when deciding timing. Use MLS listings to track comparable sales and listing durations. Factor in staging and minor updates to boost appeal. A clear exit roadmap helps you pivot if career or lifestyle needs change.

Leverage Innovative Tools and Strategies

Use digital tools to vet homes from anywhere. Immersive experiences and data-driven insights can narrow your search before in-person visits. These methods provide effective house hunting tips for buyers.

VR and 3D Tours

Platforms like Matterport create true-to-life 3D models. Capture spaces with a Pro2 camera or iOS device. Users can explore at their own pace, zoom into features, and measure rooms. Affordable options like immoviewer accept any 360 camera feed to build interactive tours.

Neighborhood Moodboards

Design a visual collage to capture neighborhood character. Use Canva or Pinterest to combine images of parks, cafes, and streetscapes. Share with your agent or household for feedback. These neighborhood moodboards help align community vibe with your lifestyle.

Short-Duration Micro-Visits

After narrowing your list to a few properties, schedule 15- to 30-minute micro-visits. Focus on key areas like the entry, kitchen flow, storage, and curb appeal. Use a mobile-first checklist to record impressions. Capture quick video notes for comparison before booking in-depth walkthroughs.

House Hunting Action Plan and Checklist

This week-long action plan integrates style, needs, emotions, finances, and tools, offering house hunting tips for buyers. Use it alongside the essential questions checklist to stay organized and reduce fatigue.

Follow These Steps to Finding Your Perfect Home

- Day 1: Secure mortgage preapproval to clarify your budget and boost offer power.

- Day 2: Use an affordability calculator for a price range estimate.

- Day 3: Define must-haves versus nice-to-haves, covering layout, style, and functionality.

- Day 4: Drive through target neighborhoods at different times to assess the vibe.

- Day 5: Schedule virtual tours or micro-visits focusing on flow and curb appeal.

- Day 6: Book in-person walkthroughs of your top picks.

- Day 7: Review scores, pros and cons, and emotional comfort before narrowing the list.

Essential Questions Checklist: Questions to Ask Yourself Before Buying a Home

- What is my preapproval limit and calculator range?

- Does the home meet bedroom, bathroom, and basement preferences?

- Is the laundry setup convenient for daily use?

- What is the age and condition of HVAC and major systems?

- How does the community feel at peak and off-peak hours?

- Will resale factors like schools and transit support my exit strategy?

Tracking and Comparison Template

Create a table with columns for:

- Property name

- Feature scores (layout, style, cost)

- Pros and cons

- Emotional rating

- Next steps

Update this after each visit. Download the full checklist to keep these questions handy throughout your search.

Conclusion

You now have a clear framework to turn house hunting from a daunting task into a focused, confident search. Keep these key takeaways in mind as you move forward:

- Define your personal style and target neighborhoods that match it

- Rank must-haves versus nice-to-haves to guide every viewing

- Recognize emotional factors in home buying and use an emotional scorecard to stay objective

- Get finances in order with a budget worksheet, hidden-cost review, and lender preapproval

- Future-proof your purchase by weighing resale value, schools, and exit strategies

- Leverage digital tools like 3D tours, neighborhood moodboards, and micro-visits

- Follow the seven-day action plan and checklist to stay organized and efficient

By applying these steps, you’ll streamline your search, avoid buyer’s remorse, and zero in on a home that truly fits your lifestyle and goals. The hunt is on,now go find a home you’ll love.

-

Legal6 days ago

Legal6 days agoMichigan man JD Vance sentenced to 2 years for threatening Trump and JD Vance

-

Politics1 week ago

Politics1 week agoU.S. to designate Maduro-linked Cartel de los Soles as terrorist organization

-

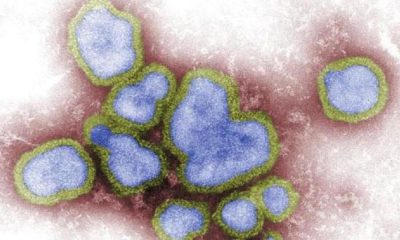

Health7 days ago

Health7 days agoCambodia reports fatal H5N1 bird flu case in 22-year-old man

-

World4 days ago

World4 days agoHurricane Melissa registered 252 mph wind gust, breaking global record

-

Legal4 days ago

Legal4 days agoWoman in critical condition after being set on fire on Chicago train

-

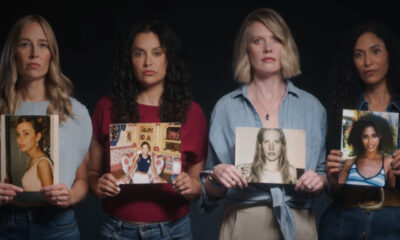

Politics7 days ago

Politics7 days agoEpstein survivors release PSA calling on Congress to release all files

-

Legal4 days ago

Legal4 days ago1 dead, 2 injured in shooting at Dallas Walmart parking lot

-

Legal3 days ago

Legal3 days agoSuspect in San Diego stabbing shot by authorities after fleeing into Mexico