Reviews

75 lakhs term insurance: A balanced cover option for young families on a budget

In this changing world, it is paramount to protect those you love with a suitable insurance policy. As the world evolves, so do mankind’s growing needs. Whether you are a single parent, independent woman, head of a small family, or a young professional, you never know how long you will be around for your loved ones. Therefore, they need financial safeguards when something unthinkable happens. That is where term insurance plans become your best friend.

What is term insurance?

Term insurance is a form of life insurance policy that you can avail of at a minimum premium with a high sum assured for a flexible tenure. These are the most affordable forms of life insurance policies designed to accommodate the needs of all.

Term insurance plans are available for as low as 30 lakhs and as high as 10 crores. You can choose single or family plans for 10 to 100 years. In the event of your demise during the policy tenure, the insurer will pay the sum assured as per the contract to your beneficiaries.

How much coverage is ideal for young families on a budget?

These days, young families are the backbone of society. They contribute healthily to the National Income and take on responsibilities of the dependents such as parents, spouse, children, pets, and sometimes non-relatives. While their generosity is highly appreciated by those around them, young families need to live on a budget. It is important to find term insurance plans that are affordable but also provide maximum benefits.

The premium for term insurance is very reasonable across different amounts of sum assured. However, the amount will increase significantly if you choose a 10 crore term insurance instead of 30 lakhs. For young families on a budget, it is important to recognise the balance between providing adequate coverage for your family without upsetting your current budget.

75 lakhs Term insurance policies are usually ideal for small young families. You can break down your income versus expenses and analyse the financial requirements of your family. For small families, 75 lakhs term insurance is a reasonable amount for a claim settlement that can help your loved ones plan their future goals and life stages and repay liabilities.

Depending on the type of term insurance policy you choose, the claim settlement of 75 lakhs term insurance plans may vary. For level-term insurance and single-premium term insurance plans, the sum assured and all other conditions of the policy will remain the same. However, if you choose increasing, decreasing or term insurance with a return of premium, you and your loved ones will be privy to other advantages.

The increasing term plan could increase the 75 lakhs term insurance value significantly in the next few years. Therefore, you need not worry about the effects of inflation. Decreasing term insurance, on the other hand, would reduce the value of the 75 lakhs term insurance but assist in repaying liabilities during your life span. Ergo, with the settlement in hand, your loved ones can plan their financial goals and focus on the household rather than worrying about debts and mortgages.

If you choose term insurance with the return of premium, a 75 lakhs term insurance plan will accumulate enough premium over the years. If you survive the policy tenure, you will receive the maturity benefit, which may serve as a savings plan that you can use to tackle financial stress.

This is why 75 lakhs term insurance plans are considered a balanced option for young families.

What are the 75 lakhs term insurance benefits for single women?

Since term insurance plans are so affordable, these are ideal for single parents, single women, and small families alike. There are many term insurance benefits for single women when you purchase the 75 lakh policy, which are as follows:

- A term insurance plan is available for very reasonable premium rates and the settlement amount is high enough to take care of your family in your absence.

- Since the premium for the 75 lakhs plan is low, you can avail of term insurance benefits for single women on taxes. If the annual premium meets the income tax criteria, then you can save money while protecting your loved ones with large rebates.

- Term insurance with a return of premium on a 75 lakhs plan can be a helpful savings system and emergency fund. It can also be your startup cost for a business in the future.

Term Insurance benefits for single women also extend to peace of mind. Single women, young professionals, small families, and single parents can easily afford the premium and safeguard loved ones. Term insurance benefits for single women are extensive, especially to help settle debts, build a future, and take care of dependents. All you need is to choose an adequate but affordable sum assured for a relevant tenure.

-

Business3 days ago

Business3 days agoYouTube restores service after widespread global outage

-

World1 week ago

World1 week agoGunmen open fire at concert in Peru, injuring members of popular band

-

World4 days ago

World4 days agoCar bomb explodes near shopping mall in Ecuador’s largest city

-

World1 week ago

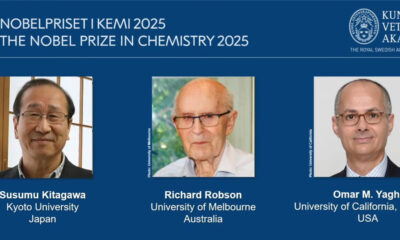

World1 week ago3 scientists win Nobel Prize in Chemistry for metal–organic frameworks

-

Legal1 week ago

Legal1 week ago4 found dead in San Francisco home in suspected murder-suicide

-

Entertainment4 days ago

Entertainment4 days agoD’Angelo, neo-soul icon behind ‘Untitled (How Does It Feel),’ dead at 51

-

World2 days ago

World2 days agoU.S. Special Operations helicopters spotted near Venezuela

-

Legal1 week ago

Legal1 week ago4 dead, including suspect, in shooting spree across Houston area