Reviews

What Common Mistakes Could Cause Me to Lose My Entire Charlotte Personal Injury Claim?

It’s the mistake you don’t even realize you’re making. In the confusing moments after a collision on a Charlotte road, you’re just trying to process the screech of tires and the smell of metal. You say, “I’m sorry,” out of pure reflex, not as an admission of guilt. You tell the adjuster, “I think I’m okay.”

It all feels harmless. But in the legal fight for compensation, these words are weapons used against you. They are the hidden traps that can severely jeopardize your claim. A potential recovery can be significantly reduced before you’ve even had your injuries evaluated.

Why Is the Period Immediately After an Accident So Important?

In the immediate confusion of an accident, adrenaline masks pain, and emotions run high. This is precisely when irreversible mistakes are made. While you are trying to understand what happened, the other driver’s insurance company is already beginning its investigation.

Their goal is to minimize or deny their policyholder’s liability. They will try to get a quick, recorded statement from you before you’ve processed everything. That single phone call is often a stark realization: the insurance company is not your friend. It’s the moment many understand they need a Charlotte personal injury lawyer empowered by Stewart Law Offices just to ensure their own rights are shielded. Without that professional advocacy, you are facing a trained negotiator completely on your own.

To discuss the specific facts of your case, appointments are available by calling 704-521-5000 or visiting their Charlotte office at 2427 Tuckaseegee Rd, Charlotte, NC 28208.

What Evidence Do Most People Forget to Collect?

Everyone knows to take pictures of the vehicles, but building a strong case requires thinking like an investigator. Valuable evidence often disappears within hours, long before you’ve even thought about a claim. To think like an investigator and preserve evidence that often disappears first, focus on these overlooked details:

Neglecting Witness Contact Information

That helpful bystander who saw the other driver run the red light will vanish in minutes. If you don’t get their name and phone number, their account of the events vanishes with them, leaving it as your word against the other driver’s.

Ignoring Surveillance Opportunities

Many businesses along roads like Providence Road have security cameras. These recordings are often automatically deleted every 24 or 48 hours. Failing to quickly request that this footage be preserved means a potentially unbiased record of the event could be lost forever.

Failing to Document the Environment

Was the stop sign obscured by a tree branch? Were the streetlights out? Take photos of the weather conditions, the road surface, and any relevant traffic signals. These details provide context that can prove essential in establishing negligence when memories fade.

How Can Speaking to the Insurance Adjuster Hurt Your Case?

An adjuster from the other party’s insurance company will likely call you very quickly, often sounding friendly and concerned. They will ask to “hear your side of the story” and request a recorded statement. This is not a friendly chat.

Every question is designed to find inconsistencies or get you to unintentionally admit partial fault. A simple “I’m doing okay” can be twisted to mean you weren’t really injured. Stating without preparation can severely damage your claim’s credibility.

When Does “Toughing It Out” Become a Legal Liability?

Many people try to avoid the doctor, hoping the soreness will just go away. This “wait and see” approach is a gift to the insurance company. They will argue that if you were truly hurt, you would have sought medical help immediately.

Imagine a collision on I-485. You feel stiff, but go home. Two weeks later, the pain is unbearable. The insurer will claim your injury must have happened during those two weeks, not in the accident, breaking the chain of causation and potentially voiding the claim.

Why Is North Carolina’s “Contributory Negligence” Rule So Strict?

A common myth is that if you are only 10% at fault, you can still collect 90% of your damages. This is dangerously false in North Carolina. The state follows a very harsh, all-or-nothing rule known as “pure contributory negligence.”

This principle means that if you are found to be even 1% responsible for the accident, perhaps for being slightly over the speed limit or not signaling a turn, you can be legally barred from recovering anything from the other driver.

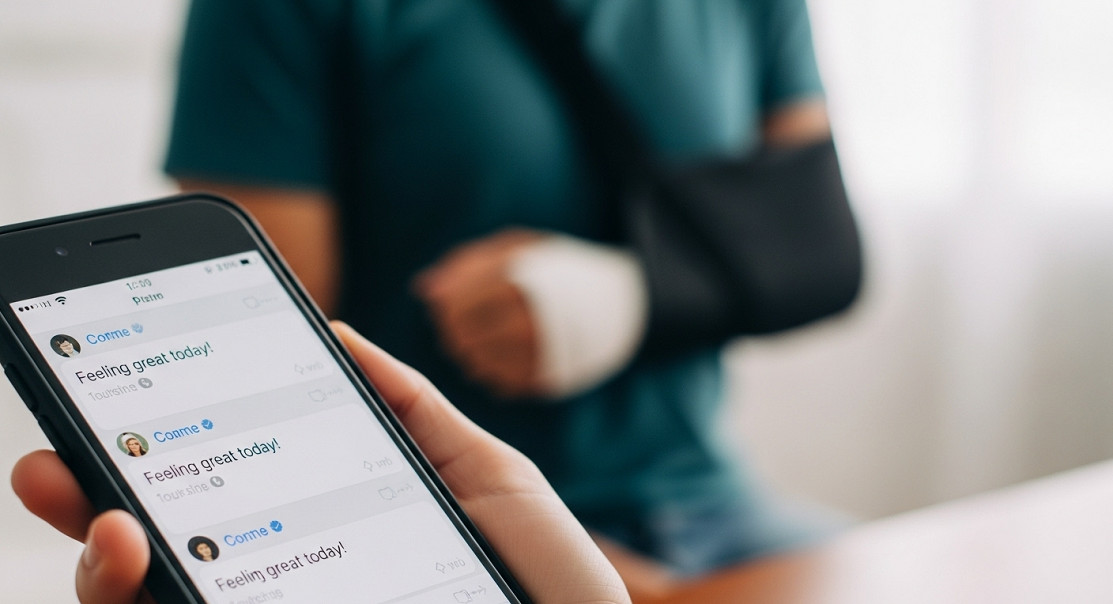

What Actions on Social Media Can Sabotage a Claim?

In modern injury claims, you should assume your public social media posts will be reviewed. Insurance investigators regularly scan social media profiles looking for any post that contradicts your claim of injury. To avoid undermining your own case online, be mindful of these social media actions that insurers can exploit:

Posting “I’m Fine” Updates

A simple post to reassure friends, like “I’m fine, just a little banged up,” will be used as a direct admission that your injuries are not serious. Adjusters will save screenshots of this and use them to deny compensation for pain and suffering.

Sharing Photos of Physical Activity

You may feel good for one day and decide to take a walk in a Mecklenburg County park. If a photo of this is posted, the insurer will argue you cannot be as injured as you claim, even if you were in severe pain the next day.

Discussing the Accident Details Publicly

Venting about the accident, blaming the other driver, or discussing settlement offers online is a massive error. These posts can contradict your official testimony, reveal privileged information, and show a jury that you are not a reliable or sympathetic claimant.

FAQs

How long do I have to file a personal injury lawsuit in North Carolina?

In most cases, the statute of limitations for personal injury in North Carolina is three years from the date of the injury. For wrongful death claims, it is typically two years from the date of death. Missing this deadline means losing your right to sue.

What happens if the at-fault driver is uninsured or underinsured?

You may be able to file a claim under your own auto insurance policy, provided you have Uninsured/Underinsured Motorist (UM/UIM) coverage. This is a separate coverage that steps in to protect you when the other driver does not have enough (or any) insurance.

Do I have to pay my medical bills while the case is ongoing?

Yes, you are still responsible for your medical bills as you receive them. Your health insurance should be used first. Any settlement you receive later will include reimbursement for these bills, but they cannot be ignored while the claim is pending.

Is it ever a good idea to give the other driver’s insurer a recorded statement?

It is rarely beneficial to give a recorded statement without legal representation. The adjuster is trained to ask questions that can be easily misinterpreted to assign blame to you. Anything you say can be used to limit or deny your claim.

-

Legal3 days ago

Legal3 days agoMichigan man JD Vance sentenced to 2 years for threatening Trump and JD Vance

-

Politics4 days ago

Politics4 days agoU.S. to designate Maduro-linked Cartel de los Soles as terrorist organization

-

World1 week ago

World1 week agoU.S. begins Operation Southern Spear against “narco-terrorists” in the Western Hemisphere

-

Health4 days ago

Health4 days agoCambodia reports fatal H5N1 bird flu case in 22-year-old man

-

Legal1 day ago

Legal1 day agoWoman in critical condition after being set on fire on Chicago train

-

World1 day ago

World1 day agoHurricane Melissa registered 252 mph wind gust, breaking global record

-

Legal1 week ago

Legal1 week agoImprovised explosive device detonates outside Las Vegas restaurant; no injuries

-

World1 week ago

World1 week agoNationwide power outage hits Dominican Republic