Reviews

Banking in Times of Economic Recession: Where Should Your Money Go?

Let’s be honest, economic recessions are stressful. Markets crash, jobs become uncertain, and suddenly, it feels like your hard-earned money is at risk. So, what should you do with it? Leave it in the bank? Invest? Stuff it under your mattress? (Okay, maybe not that last one.)

The good news is that you don’t have to panic. You just need a plan. Let’s break down how to bank wisely during tough economic times and make sure your money is working for you, not against you.

The Reality Check: How Safe Is Your Bank?

First things first, let’s talk about banking risks during a recession. You might hear horror stories about banks failing or interest rates plummeting, but not all banks are created equal. The most important thing? Make sure your money is in an FDIC-insured account (or NCUA-insured if you bank with a credit union). That means even if your bank collapses, your money, up to $250,000 per depositor, is protected.

But protection isn’t the only factor. Interest rates tend to drop during recessions, which means your savings account might not be earning much. If you’re relying on interest to grow your cash, it’s time to rethink where you’re keeping it.

Where Should You Park Your Cash?

So, if savings accounts aren’t the golden ticket, where else can you safely store your money?

- High-Yield Savings Accounts: Even though interest rates drop during recessions, some online banks still offer better returns than traditional brick-and-mortar banks. Shop around!

- Money Market Accounts: These accounts are like a hybrid between checking and savings accounts, offering slightly better interest rates with some check-writing privileges.

- Certificates of Deposit (CDs): If you won’t need access to your cash for a while, locking it into a CD with a fixed interest rate could be a smart move, especially if you snag one before rates drop further.

And don’t forget about credit unions. They often provide better rates and lower fees than big banks, which can help keep more money in your pocket when every dollar counts.

Should You Invest During a Recession?

You might be wondering, “Is investing a terrible idea right now?” Not necessarily! While the stock market can be a rollercoaster during a recession, there are still smart ways to invest without taking huge risks.

- Diversify, Diversify, Diversify: Don’t put all your money in one place. Spread it out between stocks, bonds, and other assets to lower your risk.

- Government Bonds Are Your Friend: U.S. Treasury bonds are about as safe as it gets, offering stable returns even when the economy is shaky.

- Dividend Stocks Keep Paying You: Investing in solid, established companies that pay dividends means you’ll keep earning passive income even if stock prices dip.

Not into the stock market? Some people turn to gold or real estate as safer alternatives. Precious metals tend to hold their value during downturns, and if you’re in the right market, real estate can be a good long-term play.

Debt vs. Savings: Which Should You Focus On?

Here’s the million-dollar question: Should you save or pay off debt first? The answer depends on what kind of debt you have.

- High-Interest Debt? Pay it down ASAP. Credit card debt can get out of control fast, especially if interest rates rise. Prioritize getting rid of it.

- Low-Interest Debt? Balance it with saving. If your student loans or mortgage have reasonable interest rates, it might make more sense to build up an emergency fund instead of rushing to pay them off.

Speaking of savings – how much should I have in my checking account during a recession? A good rule of thumb is to keep at least three to six months’ worth of expenses in liquid cash. This gives you a financial cushion in case of job loss or unexpected costs.

Exploring Alternative Banking & Investment Options

Traditional banks aren’t your only option these days. The rise of digital banks and fintech solutions has made managing money easier than ever.

- Online Banks: They usually offer better interest rates and lower fees than big-name banks. Just make sure they’re FDIC-insured.

- Cryptocurrencies & DeFi: Some investors see crypto as a hedge against inflation, but it’s volatile. If you’re risk-averse, sticking with stablecoins (which are tied to real-world currencies) might be a safer bet.

And let’s talk real estate for a second, if home prices drop, it could be a prime opportunity to invest. But if you’re not ready to buy property, REITs (Real Estate Investment Trusts) let you invest in real estate without actually owning it.

Final Thoughts: Making Your Money Recession-Proof

At the end of the day, recessions don’t have to be financial nightmares. With the right strategy, you can protect your money and even grow it. Keep your cash in safe, insured accounts, make smart investments, and don’t let debt spiral out of control.

Most importantly, stay informed. The economy is always changing, but the best financial decisions come from knowing your options and acting wisely. And hey, who knows? If you play your cards right, you might come out of this recession even better off than before.

-

US News1 day ago

US News1 day agoJetBlue flight diverts to Tampa after altitude drop injures at least 15

-

US News1 week ago

US News1 week agoUnwarned tornado suspected in Fort Worth as storms cause damage and power outages

-

World5 days ago

World5 days agoU.S. Navy helicopter and fighter jet crash in South China Sea; all crew rescued

-

Legal6 days ago

Legal6 days agoMultiple injured in shooting at Lincoln University in Pennsylvania

-

US News2 days ago

US News2 days agoTrump says U.S. will resume nuclear weapons testing ‘on an equal basis’

-

US News3 days ago

US News3 days agoDamage reported in Kilgore, Texas following tornado warning

-

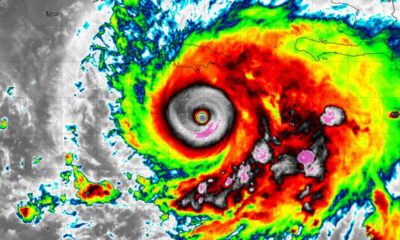

World5 days ago

World5 days agoMelissa could make landfall in Jamaica as a Category 5 hurricane

-

Legal3 days ago

Legal3 days ago3 killed in murder-suicide involving Wright-Patterson Air Force Base personnel