Reviews

Safe Ways to Send Money Abroad: From Personal Transfers to Paying Businesses and Freelancers

In an age where online scams and cyber fraudsters are becoming increasingly sophisticated, it’s never been more important to keep yourself safe online. Given that more and more of us are transferring money around the world to run businesses, hire freelancers, and pay for trips, we need to step back and find a universal approach.

The problem with local bank transfers

If you’re paying a household bill or sending a relative in another part of the country some money, a local bank transfer is more than sufficient. In many cases, they will arrive the same day, charge you minimal fees, and be perfectly secure. The problems begin when you want a more far-reaching approach that includes the ability to cross international borders and convert currencies based on exchange rates

Local banks will tend to be inflexible and incomplete in terms of the coverage they can offer, with many causing unforeseen delays and charging additional fees. Clearly, this is less than ideal, which means we need to find a specialist service that will bridge the gap.

The benefits of specialist transfer services

An international remittance service will know precisely how to navigate the complex network of intermediary banks that makes internal transfers possible. They will be fast, efficient, and able to provide you with timely updates of their progress, all for a fee that is far more competitive than the outdated approaches taken by local banks. By using such a service, you will be able to:

- Choose the method of payment so you can securely use your debit card or credit card

- Select the bank account you want to pay the money into, using a secure payment path

- Track the status of the transfer at every stage so that you can stay on top of the logistics

Now that you know such services are readily available, we need to think about how to use them in a way that keeps you and your money safe at all times.

How to stay safe online

Imagine you are paying a freelancer for work for the first time. If you don’t wish to hire them via a marketplace, you will want to establish a direct method of payment between you and them. Doing so helps you sidestep the costly commissions marketplace sites charge both parties, allowing you to secure much better value for money. To make a payment to the freelancer, you will need the following details:

- Full name and address, and the address of the bank that you are transferring to

- A written outline of the nature of the transfer that includes the total amount and currency

- A unique IBAN that identifies their account — you should also search SWIFT codes online to identify their bank

These may sound like basic things, but it’s easy to lose yourself in the details when you are trying to run a business. Taking a couple of extra minutes to ensure that everything is in order will make sure that your payment isn’t delayed because something simple has been overlooked.

Online safety red flags

Let’s stick with the example of paying a new freelancer. If they are suddenly making urgent demands for payment and trying to hurry you into making a transfer before the work has been completed as agreed, this should be cause for concern. Likewise, if they suddenly send you a different set of payment details with no explanation, this should make you think twice about doing business with them. And if they start adding extra fees and charges to the original invoice, this is another warning.

The key point here is that any legitimate freelancer or business operating abroad will not act in this way. They will present you with a single set of payment details, a clear timeframe for making payment, and a detailed account of their fees and charges. Anything that goes against this should be taken as a red flag. This especially applies to any requests to be paid in cash and offers to connect you with local contacts who can help move the cash.

The last word

Using your local bank to make a transfer is safe, but it will be costly and time-consuming. The solution is to use a specialist international remittance service to make sure that the money gets exactly where it needs to be quickly and efficiently, complete with comprehensive tracking and traceability. Anything less will expose you to undue risk and could lead to you falling victim to a scam or complex fraud.

-

US News4 days ago

US News4 days agoMedical helicopter crashes onto highway in Sacramento, California

-

World5 days ago

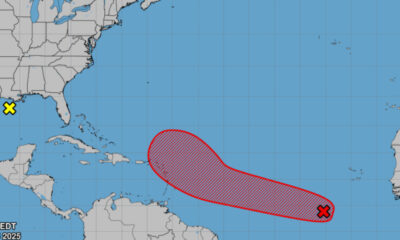

World5 days agoTropical system likely to strengthen as it moves toward the Caribbean

-

Business1 week ago

Business1 week agoFederal agency sues Apple for allegedly firing Jewish employee over his faith

-

Entertainment3 days ago

Entertainment3 days agoReggaeton artist Zion hospitalized after ATV accident in Puerto Rico

-

Politics1 week ago

Politics1 week agoColombia to expel Israeli diplomats after nationals detained on Gaza flotilla

-

World1 week ago

World1 week agoAt least 30 killed in church scaffolding collapse in Ethiopia

-

World1 week ago

World1 week agoMinnesota man pleads guilty to attempting to support ISIS

-

World1 week ago

World1 week agoDeath toll rises to 72 after earthquake in the Philippines