Reviews

How to Choose the Right Life Insurance Policy for Your Family

Choosing the right life insurance policy for your family is a critical financial decision that can provide peace of mind and security for your loved ones. With so many options available, it can be overwhelming to determine which policy is the best fit for your needs. This guide will walk you through the key factors to consider when selecting a life insurance policy, helping you make an informed choice that ensures your family’s financial future.

Understand the Different Types of Life Insurance

Have you ever wondered, “what is life insurance?” The first step of choosing a better plan is understanding the various available policies. The most common types of life insurance are term and whole life insurance.

- Term Life Insurance: This policy covers a specific period, typically 10, 20, or 30 years. The beneficiaries receive a death benefit if the policyholder passes away during the term. Term life insurance is generally more affordable than whole life insurance, making it a popular choice for young families or those on a budget.

- Whole Life Insurance: Unlike term life insurance, whole life insurance covers the policyholder’s entire life as long as premiums are paid. It also includes a cash value component that grows over time, which the policyholder can borrow against or withdraw. Whole life insurance is more expensive than term life insurance but offers lifelong coverage and can be a long-term investment.

Assess Your Family’s Financial Needs

Before selecting a life insurance policy, evaluating your family’s financial needs is crucial. Consider the following factors:

- Income Replacement: How much income would your family need to replace if you were no longer around? Consider your income, earning potential, and the years your family would need financial support.

- Debt and Expenses: Consider any outstanding debts, such as mortgages, car loans, or credit card balances. Also, consider future expenses like college tuition for your children and day-to-day living costs.

- Final Expenses: Funeral and burial costs can be significant. Ensure your policy provides enough coverage to handle these expenses without burdening your family.

Calculating these needs can help you estimate the coverage required to secure your family’s financial future.

Consider Your Budget

Life insurance premiums can vary widely depending on the type of policy, coverage amount, and circumstances. Choosing a policy that fits your budget while still providing adequate coverage is essential.

- Term Life Insurance: If you’re on a tight budget, term life insurance may be the best option, as it offers high coverage amounts at lower premiums. However, remember that coverage ends when the term expires, so you’ll need to plan for what happens if you’re still alive when the policy ends.

- Whole Life Insurance: If you can afford higher premiums and want lifelong coverage with the added benefit of cash value accumulation, whole life insurance might be a better fit. However, ensure that the premiums won’t strain your finances over time.

Evaluate the Insurance Company

Not all insurance companies are created equal, so choosing a reputable insurer with a strong financial standing is important. Consider the following when evaluating insurance providers:

- Financial Strength: Look for insurance companies with high ratings from independent agencies like A.M. Best, Moody’s, or Standard & Poor’s. These ratings indicate the company’s ability to meet its financial obligations and pay claims.

- Customer Service: Read reviews and ask for recommendations to gauge the quality of the insurer’s customer service. You’ll want a company that’s responsive, helpful, and easy to work with.

- Policy Options: Choose an insurer that offers a range of policy options, riders, and customisation features so you can tailor the coverage to your family’s specific needs.

Review the Policy Details Carefully

Once you’ve narrowed your options, carefully review the policy details to ensure they meet your needs. Pay attention to the following:

- Coverage Amount: Ensure the policy provides enough coverage to meet your family’s financial needs.

- Premiums: Understand how premiums are structured and whether they remain level or increase over time.

- Exclusions and Limitations: Be aware of any exclusions or limitations in the policy, such as waiting periods or specific conditions that may not be covered.

- Riders: Consider adding riders to your policy for additional benefits. Common riders include accidental death, waiver of premium, and accelerated death benefit, which allows you to access a portion of the death benefit if diagnosed with a terminal illness.

Consult with a Financial Advisor

Choosing the right life insurance policy is a significant decision that can have long-term implications for your family’s financial well-being. Consult a financial advisor or insurance professional if you need help deciding which policy is best. They can help you assess your needs, compare policy options, and guide you toward the best choice for your family’s future.

Conclusion

Selecting the right life insurance policy is essential in safeguarding your family’s financial future. By understanding the different types of life insurance, assessing your financial needs, and carefully evaluating your options, you can make a well-informed decision that provides peace of mind and security for your loved ones. Remember, the right policy isn’t just about finding the cheapest option—it’s about choosing the coverage that best protects your family when they need it most.

-

World6 days ago

World6 days agoEthiopian volcano erupts for first time in thousands of years

-

Legal3 days ago

Legal3 days agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News2 days ago

US News2 days agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health3 days ago

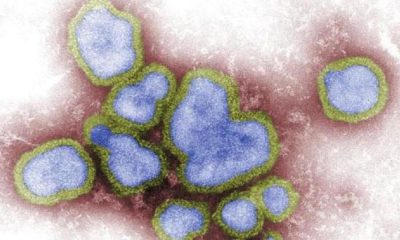

Health3 days agoMexico’s September human bird flu case confirmed as H5N2

-

Legal1 week ago

Legal1 week agoSuspect in San Diego stabbing shot by authorities after fleeing into Mexico

-

Health1 week ago

Health1 week agoMarburg virus outbreak in Ethiopia grows to 6 confirmed cases

-

World1 week ago

World1 week agoU.S. sanctions companies and vessels accused of aiding Iranian military oil sales

-

World3 days ago

World3 days agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast