Reviews

Credit Without Fear: How to Manage Your Finances Without Getting Into Debt

Loan is a common financial problem, but with the right approach, you can avoid falling into a debt trap. To grasp the seriousness of this issue, consider this United States Courts, statistics: over 80% of Americans have some form of credit. The average household debt in the U.S. exceeds $90,000. For the year ending December 31, 2023, there were 452,990 bankruptcy filings. Consumer bankruptcies, especially Chapter 7 (“liquidation bankruptcy”) and Chapter 13 (“reorganization bankruptcy”), make up more than 98% of all cases, given to Bankruptcy Watch. Contributing factors include rising interest rates, inflation, and unstable economic conditions, leading to an annual increase of 16% in bankruptcy filings.

Good news: Freedom from debt is achievable. In this article, we’ll explore common mistakes that lead to debt and methods to avoid them. Follow the expert insights from Rates.fm – manage your finance with insightful strategies on budgeting, saving and smart investing. We’ll discuss debt risk management strategies in detail. Let’s dive in!

Structuring the Problem: The Nature of Debt, Interest Rates and Rating

Before effectively managing financial liabilities, it’s crucial to grasp its nature. Debt structuring involves categorizing financial obligations into good and bad debts, understanding the associated interest rates for each obligation, and recognizing how these factors impact your credit rating.

Another helpful approach is comparing available credit options in your regional market. For those residing in the UK, platforms like 118118money.com enable consumers to explore loan and credit card products tailored to their financial circumstances, offering transparent information on interest rates and eligibility. This empowers individuals to make informed choices about borrowing while avoiding unnecessary fees or unfavorable terms.

- Good and Bad Debt

- Good debt is money you borrow to invest in or purchase assets that can generate income. For example, you might borrow to pay for education, expand a business, or buy commercial real estate. Borrowed money invested in an asset that will repay the investment with interest in the foreseeable future is considered good debt.

- Bad debt refers to borrowing that offers no financial benefit and only adds to your expenses. For instance, borrowing money to purchase appliances – items that aren’t essential – can worsen your overall financial health.

- Interest Rates

- Interest rates are the cost of borrowing money. They affect the total amount you owe: a high interest rate means higher loan payments, and a low interest rate means lower monthly payments.

The calculation of debt obligations is divided into simple and compound interest. The initial amount of liability determines simple interest (typically used for short-term loans), while the interest debt accumulates over time determines compound interest (used for long-term investments).

- Credit Rating

- A credit rating (or credit score) assesses your creditworthiness using data from your credit history. Indirect factors influencing your credit score include health status, social media activity, market conditions, inflation, unemployment, and other macroeconomic indicators.

Your credit rating – the higher it is, the better – significantly impacts your ability to secure a loan and the terms you’ll receive, including interest rates. To learn more about your credit score and the factors that affect it, visit the USAGov website. This will help you assess your options before approaching a creditor. How to improve your credit rating by competently managing your finances – Irina Tsymbaliuk knows 4 ways.

Strategies for Debt Management

There are several strategies for managing financial commitments. The effective ones can help you avoid being too heavily obligated on the way to the debt pit – bankruptcy. Here are some of the strategies to consider:

- Budgeting

After structuring your debt obligations, divide up your liability fulfillment on a calendar. Enter the total amount of debts into the budgeted “Expenses” column – correlate this column with “Revenues.” The calendar and the balancing amount between the two items will help you control spending and allocate funds to pay off dues.

- Prioritization

The structure of debt obligations sets two criteria for their fulfillment: 1) timing (calendar) and 2) interest rate amount, such as mortgage or auto loans. In the same order, they are prioritized. Additionally criterion is the impact on the credit rating: debts that can strongly affect it must be repaid first.

- Negotiating with creditors

If you find yourself unable to fulfill your debt obligations, don’t hope to avoid the consequences – they tend to accumulate. Start by discussing the possibility of renegotiating the terms of your obligations with your creditors. At a minimum, lower interest rates and consolidate debt portfolios, and at a maximum, deferring payments (Forbearance) up to Debt Forgiveness. In order not to lose money through your bankruptcy, lenders go to debtors by restructuring the liability – either reducing the interest rate or reorganizing the repayment terms of loans in the direction of prolongation (Investopedia).

While the above strategies are not a panacea, they provide a perspective on the principles of approaching debt-related challenges. If the consequences of default have already led you to litigation, repossession (Repossession and Foreclosure), or bankruptcy, seek help. Begin by researching credit-related information independently, such as using resources like RATES. Afterward, consider consulting with financial counselors or exploring mediation services.

Avoiding Debt Trap

Only proactive measures such as building an emergency fund, increasing your income and improving your financial literacy can help you avoid the debt trap. Tackling debt on a tactical level is also a matter of your discipline and informed decision-making. The vector of financial discipline should be to reduce unnecessary spending – avoiding impulse purchases and trying to stick to your budget.

Buying on credit has become a lifestyle of the modern person. Appliances, education, long-term mortgages – in the U.S., these are all made available on credit, Esusu confirms. So limit your credit card use to purchases that you can pay off in full at the end of the month.

Considering their clients’ spending habits, Rates’ financial experts highlight three effective strategies for addressing financial challenges through better financial management:

- Find additional sources of income: If your primary income doesn’t cover all your expenses, consider earning additional income. Part-time jobs, freelancing, or starting your own business should help.

- Insurance: Get the insurance you need (health, auto, home) to protect you from unexpected expenses.

- Talk to professionals: Seek help from a financial or credit counselor, if necessary. They can help you develop a strategy to manage your debt and improve your financial situation.

Conclusion

Some people view debt as an unavoidable aspect of life. Credit, in particular, provides individuals and businesses with access to financial resources when their own funds fall short. In this context, credit should be seen as an investment in the future that pays the bills today. But this is only true under the condition that you make loans, of course assessing your options.

Here are four common reasons why Americans fall into credit card debt:

- High Interest Rates

- Inflation

- Maxing Out Credit Cards

- Overspending

It also helps if you discover effective strategies for managing credit obligations and loans. Rates’ expert advice can steer you towards a healthier financial outlook. Remember, true debt freedom is achievable! To fully leverage the benefits of a financial instrument like a loan, consider free debt management counseling. It’s the first step towards your journey to financial independence.

-

Health1 week ago

Health1 week agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

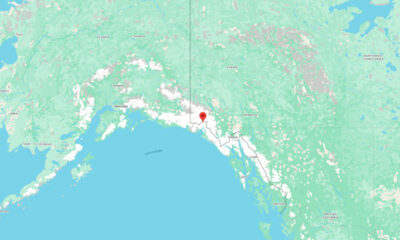

US News6 days ago

US News6 days agoMagnitude 7.0 earthquake strikes near Alaska–Canada border

-

Entertainment1 week ago

Entertainment1 week agoJoey Valence & Brae criticize DHS over unauthorized use of their music

-

Legal3 days ago

Legal3 days agoShooting at Kentucky State University leaves 1 dead and another critically injured

-

Business2 days ago

Business2 days agoUnpublished TIME cover suggests AI leaders may be named Person of the Year

-

Legal1 week ago

Legal1 week agoWoman detained after firing gun outside Los Angeles County Museum of Art

-

Entertainment1 week ago

Entertainment1 week agoSeveral countries withdraw from 2026 Eurovision after Israel is allowed to participate

-

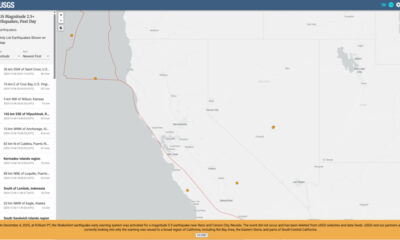

US News1 week ago

US News1 week agoErroneous earthquake warning triggers alerts across California