Reviews

Smart strategies to reduce monthly payments

Although inflation is stabilising and interest rates are expected to fall, the cost-of-living crisis has left many people struggling financially. According to The Money Charity, the average debt per UK adult in July 2024 was £477.14 higher than it was 12 months prior.

If you’re looking for ways to reduce your monthly outgoings and balance the books a little better, check out our helpful tips.

Refinancing your loans to lower interest rates

Refinancing involves replacing an existing loan with a new one on better terms – usually a lower interest rate. It can be particularly beneficial for mortgages, where rates often go up after 1-5 years, as well as personal loans. Securing a lower interest rate can quickly reduce your regular payments and decrease the amount you’ll owe over the long term.

If you have multiple debts with varying interest rates, debt consolidation loans can bring them all together in one payment. This could save you money and make it easier to keep track of your outgoings, reducing the risk of missing repayments.

Cutting unnecessary expenses

Before doing anything, though, it’s a good idea to thoroughly review your budget. Start by tracking your spending over a month to identify where your money is going.

Look for non-essential expenses such as unused subscriptions, takeaways and impulse purchases. Once you know how much you’re spending in these areas, you can eliminate them or set yourself a limit. This should free up funds for essential expenses.

Consider using a budgeting app like Emma to help you get started and monitor your progress.

Negotiating payment terms

When refinancing or cutbacks aren’t sufficient, contact your creditors to discuss lowering interest rates, adjusting repayment schedules, or reducing monthly fees.

Utility providers, credit card companies and mortgage lenders are often open to negotiation, especially if you explain your financial difficulties early on. Taking a proactive approach could result in temporary relief or more favourable terms.

Some mortgage lenders offer “payment holidays”. However, beware that this will show on your credit file and may make it harder for you to borrow money in future.

Seeking professional financial advice

Financial advisers or debt charities can help with personalised solutions, such as debt management plans or assistance programmes. They can also guide you in negotiating with creditors or restructuring your repayments to make them more affordable.

StepChange Debt Charity and National Debtline offer free, confidential advice that may be useful, too. This can include arranging a budget for you and providing tips for dealing with businesses you owe money to.

-

Legal6 days ago

Legal6 days agoMichigan man JD Vance sentenced to 2 years for threatening Trump and JD Vance

-

Politics1 week ago

Politics1 week agoU.S. to designate Maduro-linked Cartel de los Soles as terrorist organization

-

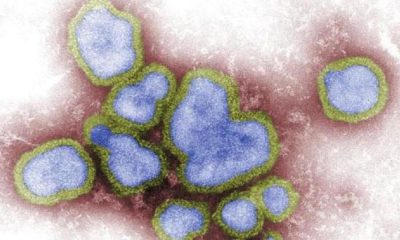

Health7 days ago

Health7 days agoCambodia reports fatal H5N1 bird flu case in 22-year-old man

-

World4 days ago

World4 days agoHurricane Melissa registered 252 mph wind gust, breaking global record

-

Legal4 days ago

Legal4 days agoWoman in critical condition after being set on fire on Chicago train

-

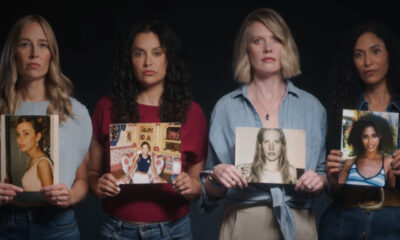

Politics7 days ago

Politics7 days agoEpstein survivors release PSA calling on Congress to release all files

-

Legal4 days ago

Legal4 days ago1 dead, 2 injured in shooting at Dallas Walmart parking lot

-

Legal3 days ago

Legal3 days agoSuspect in San Diego stabbing shot by authorities after fleeing into Mexico