Reviews

Best Practices for SEP IRA Contributions This Year

A Simplified Employee Pension (SEP) IRA is a popular retirement savings option for self-employed individuals and small business owners. Contributing wisely to a SEP IRA can yield significant future tax benefits and financial security. This article will explore the best practices for SEP IRA contributions, ensuring individuals can maximize their savings efficiently. Understanding the SEP IRA contribution limits 2024 is crucial for anyone considering this retirement plan.

Understanding SEP IRA Contribution Limits

In 2024, the contribution limits for SEP IRAs have been adjusted to provide additional benefits. Business owners’ maximum contribution is 25% of their net earnings from self-employment or $66,000, whichever is less. This adjustment and investing with SoFi enables business owners to save more for retirement while reducing their taxable income.

Contributors must keep accurate records of their earnings to ensure they do not exceed the contribution limits. Regularly checking earnings throughout the year can help determine the right amount to contribute, enabling business owners to take full advantage of these limits without running into tax problems later on.

Timing Contributions Wisely

Timing is critical when making SEP IRA contributions. Contributions can be made until the year’s tax filing deadline, including any extensions. This flexibility allows business owners to consider their earnings for that year before finalizing their contributions.

Contributors should assess their finances early in the year. This assessment helps to set a clear path for contributions. By planning, self-employed individuals can adjust their payments based on their anticipated income, ensuring they remain within the legal limits and make the most of their contributions.

Leveraging Tax Deductions

One of the main benefits of a SEP IRA is the tax deduction it offers. Contributions are made pre-tax, lowering taxable income for the year. This means more money remains in hand during the tax year to reinvest in business or personal ventures.

To maximize this benefit, individuals should keep track of all eligible contributions throughout the year. Consulting with a tax advisor can also be beneficial. They can help identify other possible deductions that enhance savings even further, making contributions even more valuable in achieving tax efficiency.

Strategies for Small Business Owners

For small business owners, making timely contributions can impact both personal and business cash flow. It is wise to set aside a portion of income specifically for the SEP IRA. This can be done on a monthly basis or at intervals that align with income inflows.

Creating an automated process for contributions can also be beneficial. This systematic approach ensures that contributions are made consistently and on time, helping to simplify financial management. Such strategies not only ensure compliance but also facilitate better savings habits.

Monitoring and Adjusting Contributions

Regular monitoring of contributions is vital to ensure compliance with IRS rules. If earnings fluctuate throughout the year, adjusting contributions may become necessary. It is essential to recalculate the allowed amounts regularly based on current earnings to avoid contributing more than permitted.

A proactive approach to financial planning helps minimize potential penalties resulting from excess contributions. Setting reminders or using financial software can help individuals stay on top of their contributions while adjusting as needed throughout the year.

Understanding the best practices for SEP IRA contributions is essential for self-employed individuals and small business owners. Knowing SEP IRA contribution limits allows for strategic planning and maximizing tax benefits. Timely contributions, leveraging tax deductions, and creating effective savings strategies contribute to long-term financial health. By monitoring and adjusting contributions based on earnings, individuals can ensure they are on the right track toward a secure retirement. With these best practices, anyone can effectively navigate the benefits of a SEP IRA.

-

Health18 hours ago

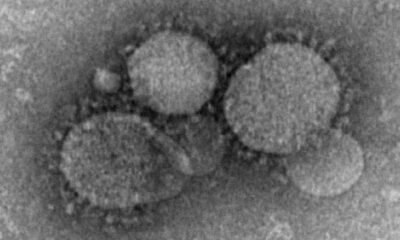

Health18 hours agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

Health3 days ago

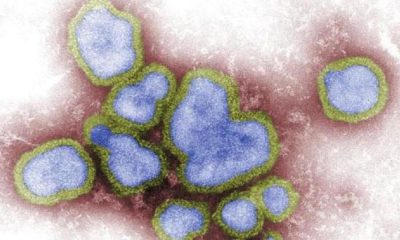

Health3 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

Legal1 week ago

Legal1 week agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News1 week ago

US News1 week agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health1 week ago

Health1 week agoMexico’s September human bird flu case confirmed as H5N2

-

Legal4 days ago

Legal4 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

World1 week ago

World1 week agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast

-

US News3 days ago

US News3 days agoFire breaks out at Raleigh Convention Center in North Carolina