Reviews

How to Prepare Financially for Unexpected Home Ownership Costs

Being financially prepared for unexpected home expenses starts with building a robust emergency fund. Many new homeowners need to pay more attention to how much a sudden repair or replacement can cost. From a broken furnace in the middle of winter to a leaking roof after a heavy rainstorm, the expenses can pile up quickly.

Setting aside a portion of your income regularly for emergency savings can be a safety net. This fund should ideally cover three to six months of living expenses, giving you enough breathing room to handle an extensive repair or multiple more minor issues without stress. It’s not just about having the money but knowing it’s there when you need it most.

Budgeting for Ongoing Maintenance

Another smart move is to budget for ongoing maintenance. While it’s easy to focus on monthly mortgage payments and utilities, ongoing maintenance is often overlooked. Routine upkeep, like servicing your HVAC system or maintaining your landscaping, can help prevent more significant, more expensive problems down the line.

For instance, a clogged gutter might seem like a minor issue, but if left unattended, it can lead to water damage and costly repairs. Allocating a monthly or annual budget for such maintenance tasks ensures your home stays in good shape and reduces the chances of unexpected major repairs. It’s a proactive approach that pays off over time.

The Importance of Insurance Coverage

Insurance plays a crucial role in safeguarding your finances when you own a home. Homeowners insurance is not just a requirement; it’s a vital tool for financial protection. It can cover a range of incidents, such as fire, theft, or damage from natural disasters. However, not all policies are created equal.

Reviewing your policy carefully and considering additional coverage options like flood or earthquake insurance if you live in an area prone to such events is essential. The right insurance can significantly mitigate the impact of unexpected costs, but it’s necessary to understand what is covered and what is not. This way, you won’t face unwelcome surprises when filing a claim.

Using Financial Tools

Tools like an APY monthly calculator can benefit those looking to maximize their savings potential. This tool helps you understand how much interest your savings could earn over time, allowing you to make better decisions about where to keep your emergency fund.

Placing your savings in a high-yield savings account can earn more interest than a standard savings account. An APY calculator can show you the difference this makes over several months or years, helping you reach your savings goals faster. It’s a small step that can significantly impact your preparedness for unexpected expenses.

Saving for Major Repairs and Replacements

Another factor to consider is the potential need for more extensive repairs, like a new roof or a complete plumbing overhaul. Unlike more minor maintenance issues, these are capital expenses that require more planning. A good rule of thumb is to save 1-3% of your home’s value annually for repairs and replacements.

For example, if your home is valued at $300,000, setting aside $3,000 to $9,000 yearly can help cover these significant costs when they arise. This approach ensures you have the funds when a major system fails without dipping into your emergency savings. It’s about building a cushion to address big-ticket items without derailing your long-term financial goals.

Planning for Rising Property Taxes and HOA Fees

Unexpected costs can also come in property taxes and homeowners association fees. While these are often included in monthly mortgage payments, they can fluctuate year by year. Rising property values can lead to higher property taxes, and homeowners associations may increase fees for community maintenance or improvements.

Knowing these potential changes and planning them in your budget helps prevent sudden financial strain. Reviewing your property’s assessed value regularly and appealing it if you believe it’s too high can be one way to manage rising taxes. Similarly, watching HOA meeting minutes can give you insight into potential fee increases. Proactive planning in these areas can go a long way in maintaining your financial stability.

Considering Mortgage Refinancing

It’s also worth considering refinancing your mortgage when interest rates drop. Lowering your monthly payment through refinancing can free up cash that you can allocate to your emergency fund or savings for future repairs. However, it’s crucial to weigh the costs of refinancing, such as closing costs, against the potential savings.

A well-timed refinance could not only save you money but also put you in a better position to handle those inevitable homeownership expenses. It’s about striking a balance between immediate savings and long-term financial planning.

Investing in Regular Home Inspections

Finally, even after the initial purchase, regular home inspections can be a wise investment. Hiring a professional to assess the condition of your home every few years can help you identify potential problems before they become costly repairs. This approach might involve a small upfront cost but can save you thousands in the long run.

For instance, an inspector might spot early signs of foundation issues, allowing you to address them before they become a significant structural problem. It’s about being proactive, not reactive, regarding home maintenance. Staying ahead of issues keeps your home in good condition and your budget intact.

Conclusion

Preparing financially for unexpected homeownership costs requires a thoughtful approach. From building an emergency fund and budgeting for maintenance to using smart tools and keeping an eye on potential cost fluctuations, these steps can help you navigate the financial challenges of owning a home.

The goal is to stay ahead of expenses rather than being caught off guard. With proper planning, homeowners can enjoy the rewards of their investment without the added stress of surprise costs.

-

Legal6 days ago

Legal6 days agoMichigan man JD Vance sentenced to 2 years for threatening Trump and JD Vance

-

Politics1 week ago

Politics1 week agoU.S. to designate Maduro-linked Cartel de los Soles as terrorist organization

-

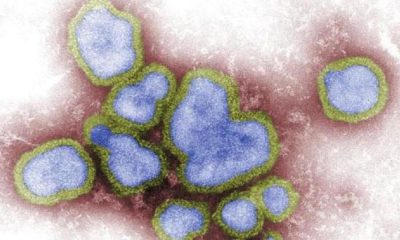

Health7 days ago

Health7 days agoCambodia reports fatal H5N1 bird flu case in 22-year-old man

-

World4 days ago

World4 days agoHurricane Melissa registered 252 mph wind gust, breaking global record

-

Legal4 days ago

Legal4 days agoWoman in critical condition after being set on fire on Chicago train

-

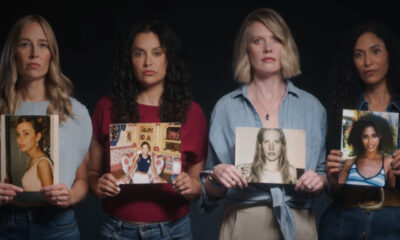

Politics7 days ago

Politics7 days agoEpstein survivors release PSA calling on Congress to release all files

-

Legal4 days ago

Legal4 days ago1 dead, 2 injured in shooting at Dallas Walmart parking lot

-

Legal3 days ago

Legal3 days agoSuspect in San Diego stabbing shot by authorities after fleeing into Mexico