Reviews

The Impact of Big Data and Analytics on the Future of Financial Services

We have now started to learn about the power of big data, especially when we talk about analytics and AI. This is a relatively new trend that quickly made it into almost every industry, including the financial industry.

I know this subject might sound boring, or you may be even scared of what the future will bring considering the advancements of this tech in just a short period, but it is what we need to talk about just so we can prepare for what’s coming.

Big data and analytics already greatly impact financial services, and this trend will continue into the future.

So, let’s highlight all the ways that big data impacts our everyday financial services, and find out what it means for us.

The Role of Big Data

When you look at it, financial institutions have always relied on data, but that data is useless if it cannot be analyzed, right? In today’s world, the sheer volume and variety of data is unprecedented. It is way beyond the capabilities of a human to analyze that data, which means that we need other services that will help us spot patterns.

There are many data points, such as transactional data, customer behavior, spending, social media, browsing habits, loans or credit scores, and tons of other data points that financial institutions can collect.

Since we live in a tech-driven world where data has become more valuable than oil (as a resource), financial services are sitting on a goldmine of information.

So, how can they use this data?

Well, first of all, they’ll need machine learning software or AI just to be able to go through the numbers and find possible patterns. By analyzing data points, financial institutions can increase their profits by offering what people prefer most, which can improve customer experience as well as personalization.

Need an example? Personalization through big data helped reduce customer churn by 15% in banks that fully integrated it into their strategies, as noted by McKinsey.

Predictive Analytics

Did you know that if you have big enough data, you’ll be able to predict market fluctuations, trends, and even the stock market? It might not be 100% accurate, but it comes really close to being able to predict the future.

So, can you imagine what it would be like if financial institutions had a tool like this? I don’t see why it would be impossible. They have historical data that can be used to forecast future trends.

This can be used in many different ways by banks, such as identifying which clients are likely to leave, the best loans and time to offer them, potential new clients, market movements, real estate prices, and many other things.

Financial institutions will be able to boost their profits using a predictive analytics model, but only if the model is based on big data, and they use software powered by AI to spot future patterns.

This cannot be done by a human.

Some features might also be available to consumers like you and me. Let’s say that you have a multi-currency account. The software would then suggest which is the best currency to keep based on historical data.

If you want to learn more about online payment platforms with multi-currency options, you can check out genome.eu.

Real-Time Decision Making

With the rise of real-time analytics, financial firms can now make decisions on the fly. Imagine approving a loan, making a trade, or assessing risk almost instantaneously. This isn’t just a neat trick; it’s a game-changer.

Real-time data has become a top priority for financial institutions, particularly in trading, where even a fraction of a second can make or break a profit. The move toward real-time analytics has also driven an increase in the use of machine learning algorithms for processing vast amounts of data rapidly.

Reducing Fraud and Strengthening Security with Big Data

Big data analytics is invaluable in fraud detection. By leveraging machine learning, institutions can recognize patterns indicative of fraudulent activities. Banks like JP Morgan and HSBC have already implemented big data-driven fraud detection systems that detect irregular transaction patterns, flagging potential fraud before it even occurs.

Advanced analytics has cut down on fraud-related losses by up to 40% in some banks. Imagine spotting unusual transactions, like a sudden $5,000 withdrawal from a usually dormant account, in real time. This kind of proactive approach not only protects customers but also saves banks millions.

Enhanced Risk Management

Managing risk has always been a core function of financial services, and big data analytics has brought this to a new level. Today, with the help of advanced algorithms, financial institutions can quickly assess and manage risks based on current and historical data.

According to Deloitte, integrating big data into risk management strategies can improve risk predictions by nearly 25%.

For example, data-driven risk models can assess an individual’s or business’s creditworthiness based on a broader range of factors, including non-financial behaviors. This makes risk assessment fairer and more accurate, minimizing defaults and enhancing the stability of financial systems.

Customer-Centric Strategies: Because Finance is Personal

At the end of the day, every bank or financial service wants one thing: loyal customers. Big data analytics let financial institutions understand customer preferences and behaviors, creating personalized experiences that build loyalty. A recent survey showed that customer-centric banks using data analytics have seen up to a 10% increase in customer retention rates.

Here’s a practical example: a bank might notice that you spend a lot on travel, so it offers you a credit card with travel rewards. Or maybe you’re saving for a home, so they suggest a personalized savings account. This isn’t just good business—it’s using data to meet customers where they are in life.

-

Health2 days ago

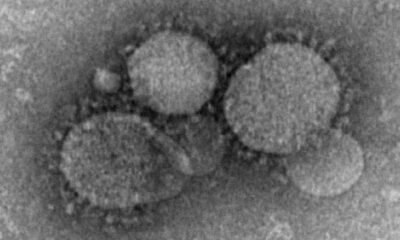

Health2 days agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

Health4 days ago

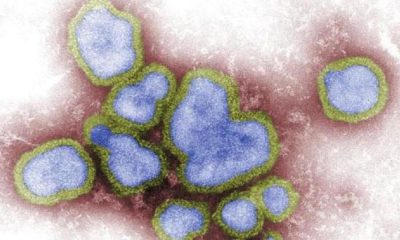

Health4 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

Legal1 week ago

Legal1 week agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News1 week ago

US News1 week agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health1 week ago

Health1 week agoMexico’s September human bird flu case confirmed as H5N2

-

Legal5 days ago

Legal5 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

US News4 days ago

US News4 days agoFire breaks out at Raleigh Convention Center in North Carolina

-

World1 week ago

World1 week agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast