Reviews

What Makes Prop Trader a Promising Career?

There are several factors that need to be put in place before a trader can make significant profits from any financial market. These factors include the ability to open large positions, access to the best resources, and a good knowledge of the market. Modern traders already enjoy access to more information, which helps them develop a strong understanding of the market. However, trading with a huge capital and access to the best resources requires significant financial investment. There are many ways for traders to solve these issues, one of which is to become a prop trader.

How Does Prop Trading Work?

Most traders start out trading with their funds, which are usually small in the beginning. They can gradually increase their capital by making more returns if they are good enough.

What prop trading offers is a chance for the best traders to make higher earnings much earlier in their career. This is possible by accessing trading capital owned by financial institutions like banks, brokers, and investment firms.

One example of prop trading is the OANDA Prop Trader program, which provides qualified traders with large virtual capital, good trading conditions, and learning resources suitable for traders at every level. In prop trading, the provider and traders are connected via five main features:

- Trading Capital: Provided to the trader to facilitate trades.

- Trade Execution: Handled by the provider.

- Profit Sharing: Profits are shared between the trader and the provider.

- Account Protection: Measures are in place to safeguard the trader’s account.

- Resource Access: Traders are granted access to advanced tools and resources.

Why Is Prop Trading a Promising Career Path?

There are several reasons why traders should explore this career path. Here’s a few of them:

Proper training and skill development

Prop account providers require their traders to reach specific skill levels, which they showcase by passing challenge accounts. Proper training is crucial to achieving such levels of trading mastery. For most prop traders, the chance to learn to trade on a deeper level and access high-quality resources provided by their prop firm is too good to pass on.

Prop trading also ensures that traders hone their skills and develop mentally and physically. This is because of the strict rules that keep traders on their toes. With prop trading, traders can build the discipline and consistency that translates to other aspects of their lives.

Stable income

Consistency and stability are two important qualities that traders need to stay profitable. When you think of prop trading, think of percentages and long-term stability. Prop accounts provide traders with trading capital and profit-sharing models, which allow traders to keep a major share of their profits.

This model is mutually beneficial to traders and prop account providers. Profit sharing means traders can receive a stable income while keeping similar trading metrics. For example, a trader with a $25,000 prop account can set a 1% profit target and receive 90% of the profit. That amounts to $225 in profit and can be replicated several times following the same strict rules.

Higher Salary Than Similar Roles in Securities

Professional traders get salaries on par with many other careers, especially in the financial sector. Prop traders have an advantage here, thanks to the unique payment structures. Higher capital means that traders can command higher salaries than others in the securities market. For instance, professional traders, asset managers, and investment analysts have higher salaries than entry-level finance employees and can access more benefits.

Accessibility and support

Prop-funded traders can access structured and professional support and assistance from other traders, analysts, and managers. Prop firms provide trading capital, advanced tools, and technical support for traders. In this way, prop firms reduce the barrier to trading and ensure traders from diverse backgrounds have a level field to deliver. Trading communities, built by and around prop firms, provide traders with psychological support to manage emotions and expectations. Such trading communities are also excellent for helping beginners develop a promising career by interacting with experienced traders.

Flexibility and independence

One of the main attractions for traders is the opportunity to be independent and enjoy work flexibility. With prop firms, traders can have a successful career where they have the agency to make their own trading decisions and be financially independent within a regulated and secure industry. Trading is one of the top careers, allowing anyone to work from their smartphone or computer, travel to remote regions, and maintain access to global markets.

Prop trading offers this on a platter, with higher capital and the right tools for market analysis, trade management, and communication. With prop firms, traders can safely explore different markets and trade strategies that align with their overall goals.

Advanced Tools And Technology

Technological advances continue to open up new windows for work and investment. In the trading space, brokers continually refine their technologies to offer traders systems that ensure speed, stability, security, and accessibility. Prop firms take this a notch higher by deploying the latest updates and tools to their traders. OANDA, for instance, says it uses cloud-based technologies and industry-standard security protocols for stability and to protect funds and information. There are also tools to track relevant market developments and other news within the trading industry.

Career Growth And Scaling Opportunities

A trading career could unlock your finances, providing the funds you need to reach your goals. Yet, in trading, potential profits depend on the trading capital. Traders with larger capital can take more calculated trades, use bigger lot sizes, and explore more markets than those with smaller capital. Prop trading provides beginner traders with a career path to become professionals and trade with higher capital.

For example, OANDA Prop Trader offers prop accounts starting from $5,000 and up to $500,000 in virtual funds. Traders can launch their careers with a token fee and access virtual funds that are more than they can afford for self-funded trading.

How To Build A Promising Trading Career

Professional trading can be a lifelong career that requires consistent learning and improvement. Although the basic principles of trading are unchained, market dynamics demand focus and keeping updated with events. To build a successful trading career, focus on developing core trading skills and an in-depth understanding of market forces. Learn the trading tools you need and become familiar with them. Next, register a prop trading account and start trading. It is important to trade with a reliable and sustainable prop firm with a reputation for self-sufficiency and a traders-first approach.

-

Health1 week ago

Health1 week agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

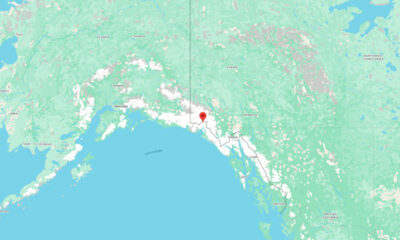

US News6 days ago

US News6 days agoMagnitude 7.0 earthquake strikes near Alaska–Canada border

-

Entertainment1 week ago

Entertainment1 week agoJoey Valence & Brae criticize DHS over unauthorized use of their music

-

Legal3 days ago

Legal3 days agoShooting at Kentucky State University leaves 1 dead and another critically injured

-

Business2 days ago

Business2 days agoUnpublished TIME cover suggests AI leaders may be named Person of the Year

-

Legal1 week ago

Legal1 week agoWoman detained after firing gun outside Los Angeles County Museum of Art

-

Entertainment1 week ago

Entertainment1 week agoSeveral countries withdraw from 2026 Eurovision after Israel is allowed to participate

-

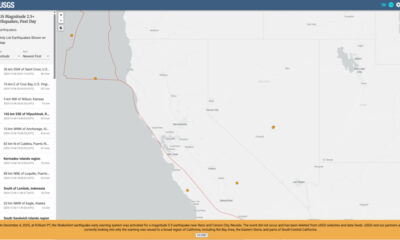

US News1 week ago

US News1 week agoErroneous earthquake warning triggers alerts across California