Reviews

Lake Geneva Market Correction: Understanding the 8.1% Price Decrease in 2025

It is quite common for the real estate market to go down or up occasionally. Reports show that the average home prices in Lake Geneva decreased by 8.1% in January 2025 compared to last year.

Such a price drop may or may not seem like a huge deal at first. However, understanding the underlying factors is quite important if you want to make a worthwhile investment in its real estate market.

With that said, let’s dive into this article and discuss everything you need to know about Lake Geneva’s market correction in 2025.

Lake Geneva Market Trends and Insight

In January 2025, Lake Geneva’s real estate market saw an 8.1% decrease in the average housing cost compared to the previous year. The overall median home price now stands at $330,000 (Source: Redfin). The waterfront homes listing dropped almost to 0 for this reason.

| Lake Geneva Real Estate Market Trends | |||

| Median Sale Price | Median Days on Market | Sale-to-List Price | Total Homes Sold |

| $330,000 | 70 | 93.6% | 20 |

At a glance, it might seem like an alarming issue to potential investors and homeowners. But if we take a look at the current market trends in a broader scope, it paints a better picture.

It becomes even more apparent if we see the YoY growth of these markets. They go through such fluctuations at this particular time of the year due to certain factors. That brings us to our next topic.

Key Contributing Factors to the Price Decrease in Lake Geneva

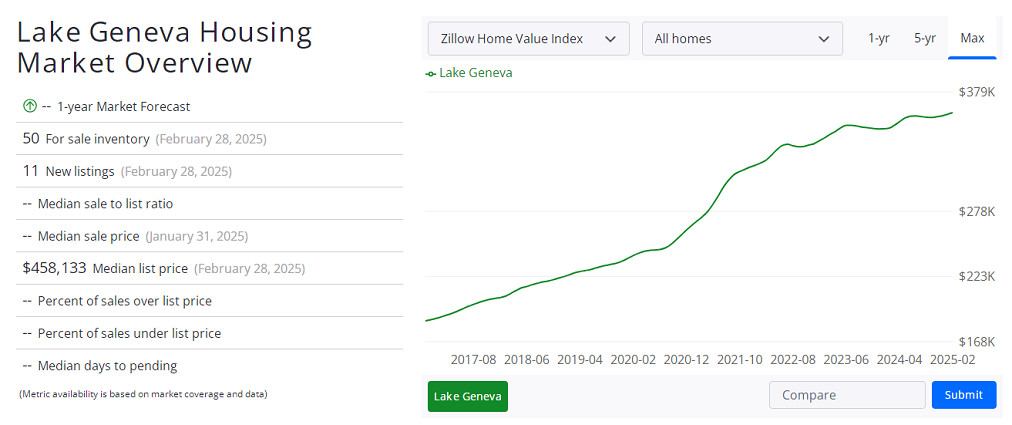

Lake Geneva’s real estate market has mostly remained stable for the most part, at least for the YoY growth in the last 5 years.

However, like any market, it’s subject to fluctuations driven by various economic and social factors. Such as:

1. Supply and Demand Highlights

One of the main reasons behind the recent price drop is the shift in supply and demand. A higher number of homes on the market generally creates a buyer’s market. This ultimately forces sellers to reduce prices to remain competitive.

That’s exactly what happened in Lake Geneva. The number of total listings has increased by 21% compared to what it was at the end of last year.

This influx of properties for sale has placed downward pressure on prices as sellers adjust to meet demand.

2. Socio-Economic Context

The country’s broader economic conditions have also played a role in Lake Geneva’s market correction.

According to official reports, the inflation rate in the US is currently around 3%.

This, combined with economic uncertainty and concerns over job stability, has made many potential buyers hesitant to invest in high-value assets like real estate.

In short, a slowing economy can reduce consumer confidence. This leads to fewer transactions and lower home prices. In Lake Geneva, this has contributed to the aforementioned decline in property values as buyers are taking a more ‘wait and see’ approach.

3. Interest Rates

Mortgage rates significantly impact housing affordability.

Over the past year, fluctuating interest rates have made loaning more expensive for prospective homeowners. Subsequently, higher interest rates increase monthly mortgage payments, reducing the purchasing power of buyers.

As a result, demand has softened, which is causing sellers to lower prices to attract buyers.

If interest rates remain high or continue to rise, this could further impact home prices in Lake Geneva.

4. Seasonal Variations

Since Lake Geneva is mostly a resort city, it is bound to experience seasonal trends.

Historically, winter months tend to see slower sales activity as fewer buyers are actively searching for homes.

The price decrease observed in early 2025 could be partially attributed to this seasonal slowdown. However, if prices do not rebound(which is highly unlikely) in the spring and summer months, it may indicate some other issues rather than just a seasonal trend.

Lake Geneva Real Estate Market Forecast

Looking forward, Lake Geneva’s market is expected to stabilize in the latter half of 2025.

Although the recent correction in 2025 can not be ignored, the area’s continued appeal as a vacation and waterfront destination should support long-term property values.

And the recent data supports this notion as well.

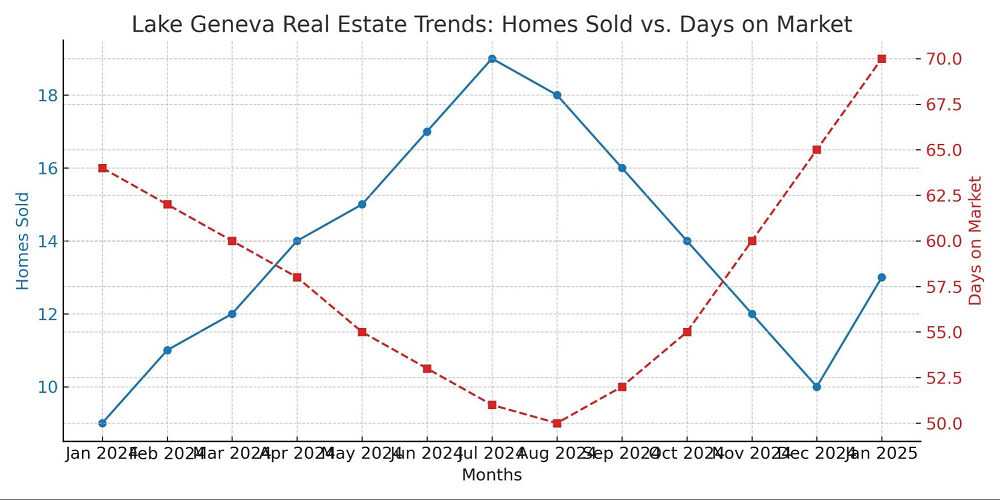

In January 2025, 13 homes were sold, up from 9 in the same month of the previous year. However, the time taken to sell a home has extended. Properties now spend an average of 70 days on the market compared to 64 days previously.

What It Means for Investors and Stakeholders

The projected market correction for Lake Geneva indicates a strong sign of healing.

The continued decline in the number of houses being sold has finally stopped and is trending upwards. Not only that, but the projected YoY growth also shows a 3% increase in the median listing price.

So if you grab a property at its current value, you have a huge opportunity of seeing a healthy ROI(return on investment).

And if the market follows the trend from the previous years, you can expect an average housing price of $550,000 by the middle of this year.

That’s great news for anyone with an intention of long-term investment.

Wrapping Things Up

The 8.1% price decrease in Lake Geneva’s real estate market underscores the importance of understanding what makes the market tick. So whether you’re an investor or a homeowner, follow the trend and utilize the insights properly to get the most out of your deal.

-

World1 week ago

World1 week agoEthiopian volcano erupts for first time in thousands of years

-

Health2 days ago

Health2 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

Legal7 days ago

Legal7 days agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News6 days ago

US News6 days agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health7 days ago

Health7 days agoMexico’s September human bird flu case confirmed as H5N2

-

Legal3 days ago

Legal3 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

World1 week ago

World1 week agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast

-

US News2 days ago

US News2 days agoFire breaks out at Raleigh Convention Center in North Carolina