Reviews

The Role of Financial Transparency in Small Business Operations: Boost Trust and Growth

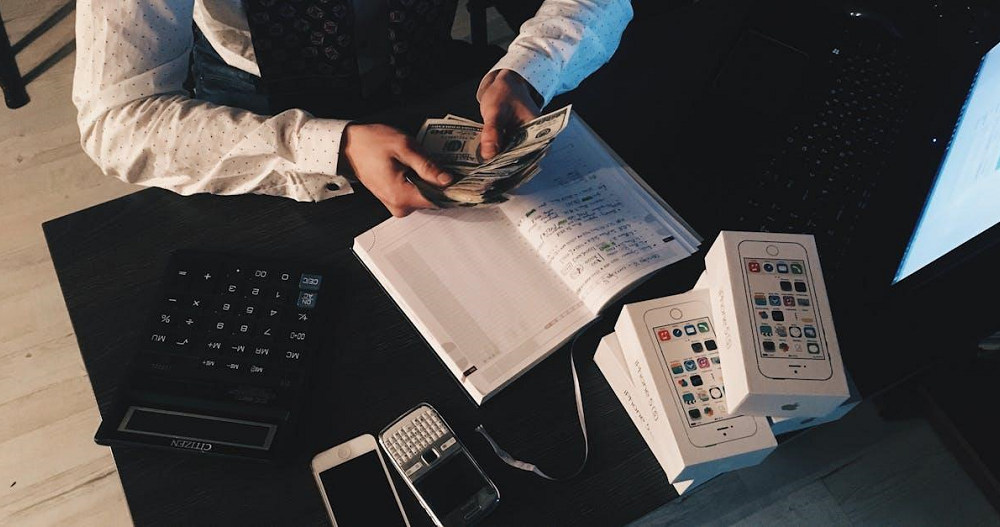

In today’s competitive landscape, financial transparency is more than just a buzzword; it’s a crucial element that can make or break small businesses. We all know that trust is foundational in any relationship, and this is especially true for businesses. When we embrace transparency in our financial operations, we not only foster trust with our clients and partners but also streamline our decision-making processes.

Understanding the ins and outs of our finances can empower us to make informed choices, ultimately leading to growth and sustainability. By prioritizing financial transparency, we position ourselves for success while navigating the complexities of running a small business. Let’s explore how this vital practice can transform our operations and enhance our overall business strategy.

Understanding Financial Transparency

Financial transparency involves clear, accessible reporting of a business’s financial activities. Prioritizing transparency helps us build trust and facilitates informed decision-making, essential for achieving growth.

Definition and Importance

Financial transparency means providing accurate and timely information about financial operations. It represents a commitment to openness, helping stakeholders understand our financial health. This clarity not only fosters trust among investors and clients but also enhances our reputation within the industry. By ensuring stakeholders grasp essential details, we improve accountability, strengthen partnerships, and lay a foundation for sustainable growth.

Key Components of Financial Transparency

Key components of financial transparency include accurate financial statements, regular audits, and accessible reporting. We focus on sharing income statements, balance sheets, and cash flow statements with stakeholders to ensure clarity. Part of this transparency extends to employees as well — for example, understanding what type of information should you see when you look at your paystub? It empowers employees to verify the accuracy of their earnings and deductions, reinforcing trust at every level of the organization.

Implementing systematic audits safeguards our processes and validates our reports. Moreover, providing accessible information through online platforms allows us to serve clients and partners effectively. In some industries, this commitment to transparency and accountability extends even into daily operations, where tools like a dash cam radar detector can help monitor fleet safety and performance, offering additional layers of oversight.

Each component creates a transparent financial culture, ensuring all parties have the knowledge needed to make informed decisions.

Benefits of Financial Transparency in Small Businesses

Financial transparency offers several significant advantages for small businesses. It enhances trust, facilitates better decision-making, and promotes a culture of accountability.

Improved Trust and Credibility

Financial transparency strengthens trust and credibility among customers and partners. When we provide clear financial information, it shows our commitment to openness. Clients feel more secure knowing how we manage financial resources, fostering lasting relationships. Increased transparency invites inquiries about revenue, expenses, and profit margins, which in turn builds confidence in our brand. As a result, we position ourselves as responsible stewards of financial accountability, encouraging loyalty and repeat business.

Better Decision Making

Financial transparency supports more informed decision-making. By routinely analyzing clear financial statements and reports, we gain insights into cash flow, profits, and expenses. This accessible information allows us to identify trends and potential challenges, enabling us to make proactive adjustments. Informed decisions, based on reliable data, enhance our ability to allocate resources effectively, invest wisely, and ultimately drive growth. By prioritizing transparency, we set the foundation for sound financial management, leading to sustainable success.

Challenges to Achieving Financial Transparency

Achieving financial transparency presents several challenges for small businesses. Identifying these obstacles is crucial for enhancing our operational effectiveness.

Common Obstacles Faced by Small Businesses

Limited resources often restrict small businesses from maintaining detailed financial records. Many lack the tools necessary for accurate tracking of expenses and revenues. Inconsistent reporting practices can further complicate our clarity on financial standing. In some cases, a lack of financial literacy among staff may lead to errors in understanding vital financial documents, such as paystubs or profit and loss statements. These factors together create an environment where transparency becomes difficult to achieve.

Strategies to Overcome Challenges

Implementing standardized reporting procedures simplifies financial tracking. Regular training sessions boost our team’s financial literacy, enhancing their ability to interpret financial data correctly. Utilizing financial management software streamlines the collection and presentation of financial information, improving accuracy and access. Conducting periodic audits helps identify discrepancies, while fostering a culture of accountability encourages transparency among all team members. Adopting these strategies increases our capacity to achieve and maintain financial transparency.

Implementing Financial Transparency Practices

Implementing financial transparency practices is crucial for fostering trust and accountability in small business operations. By adopting best practices and utilizing appropriate tools, we can establish a transparent financial culture.

Best Practices for Small Businesses

- Standardize Reporting: We must create consistent financial reporting formats that include income statements, balance sheets, and cash flow statements.

- Conduct Regular Audits: We should schedule annual audits to identify discrepancies and enhance accuracy in financial reporting.

- Provide Financial Training: We need to invest in training sessions for staff to improve financial literacy. Educating employees about financial documents enables better understanding and reduces errors.

- Encourage Open Communication: We can foster an environment where employees feel comfortable discussing financial matters, thus promoting accountability and transparency.

Tools and Resources to Facilitate Transparency

- Accounting Software: We can leverage tools like QuickBooks or Xero for real-time financial tracking and reporting, making information accessible.

- Financial Dashboards: Utilizing platforms that offer visual representations of financial data allows us to monitor key metrics at a glance.

- Cloud Storage Solutions: We should use secure cloud services to store financial documents, ensuring easy access and collaboration while maintaining security.

- Resource Guides: Consulting resources from organizations like the Small Business Administration can provide valuable insights on best practices in financial management.

By focusing on these best practices and employing the right tools, we position ourselves for success and maintain a commitment to financial transparency. For more insights on financial best practices, check out resources from the Small Business Administration.

-

World1 week ago

World1 week agoEthiopian volcano erupts for first time in thousands of years

-

Health2 days ago

Health2 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

Legal7 days ago

Legal7 days agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News6 days ago

US News6 days agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health7 days ago

Health7 days agoMexico’s September human bird flu case confirmed as H5N2

-

Legal3 days ago

Legal3 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

World7 days ago

World7 days agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast

-

Health6 days ago

Health6 days agoMarburg outbreak in Ethiopia rises to 12 cases and 8 deaths