Reviews

Opening an Online Checking Account: How Banks Protect Your Information

When you open a checking account online, banks employ sophisticated encryption technology to protect your data during transmission. This typically includes 256-bit SSL (Secure Sockets Layer) encryption, the same level of security used by major e-commerce sites and government agencies. This encryption scrambles your personal information, making it virtually impossible for unauthorized parties to intercept and read your data.

Additionally, banks use end-to-end encryption, meaning your information remains encrypted from the moment you enter it until it reaches the bank’s secure servers. Look for the padlock icon in your browser’s address bar when you open a checking account online; this indicates the connection is secure and encrypted.

Identity Verification Systems

Banks have implemented comprehensive identity verification processes to prevent fraud.. These systems typically involve multiple verification steps, including document scanning technology that can detect fake or altered identification documents in real-time.

Many institutions use advanced biometric verification, such as facial recognition technology that compares your live image to your government-issued ID. Some banks also employ voice recognition or fingerprint scanning through mobile devices. These multi-factor authentication methods ensure that only legitimate account holders can successfully open a checking account online.

Real-Time Fraud Monitoring

Advanced artificial intelligence and machine learning algorithms continuously monitor account opening applications for suspicious patterns. These systems analyze hundreds of data points in real-time, including device information, location data, and behavioral patterns, to identify potential fraud attempts before accounts are opened.

These systems work invisibly in the background, flagging any irregularities that might indicate fraudulent activity. This proactive approach helps protect both you and the bank from identity theft and financial crimes.

Secure Data Storage and Handling

Once you submit your information, banks store your data in highly secure, encrypted databases that comply with strict federal regulations. These systems are regularly audited and tested for vulnerabilities, with access restricted to authorized personnel only.

Banks also implement data minimization practices, collecting only the information necessary for account opening and securely disposing of any temporary files or cached data after the process is complete. Your sensitive information is never stored on unsecured servers or shared with unauthorized third parties.

Regulatory Compliance and Oversight

Financial institutions must comply with numerous federal regulations designed to protect consumer data, including the Fair Credit Reporting Act and various anti-money laundering laws. These regulations require banks to implement specific security measures and undergo regular compliance audits.

You’re protected by these comprehensive regulatory frameworks that mandate how banks must handle, store, and protect your personal information. Violations can result in significant penalties, giving banks strong incentives to maintain the highest security standards.

What You Can Do to Stay Safe

While banks provide robust security measures, you can take additional steps to protect yourself.. Always use a secure, private internet connection – avoid public Wi-Fi networks for financial transactions. Ensure your device has updated security software and that you’re accessing the bank’s official website directly, not through email links.

Create strong, unique passwords for your online banking accounts and enable two-factor authentication whenever possible. Regularly monitor your accounts for any unauthorized activity and report suspicious transactions immediately.

The security measures banks employ are comprehensive and continuously evolving to address new threats. By understanding these protections and following basic security practices, you can confidently take advantage of the convenience and efficiency that digital account opening provides.

-

World1 week ago

World1 week agoEthiopian volcano erupts for first time in thousands of years

-

Health2 days ago

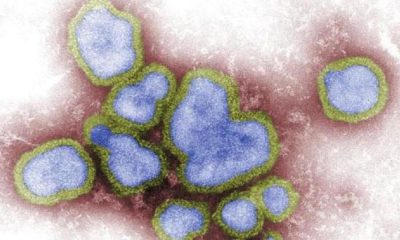

Health2 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

Legal7 days ago

Legal7 days agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News6 days ago

US News6 days agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health6 days ago

Health6 days agoMexico’s September human bird flu case confirmed as H5N2

-

Legal3 days ago

Legal3 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

World7 days ago

World7 days agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast

-

Health6 days ago

Health6 days agoMarburg outbreak in Ethiopia rises to 12 cases and 8 deaths