Reviews

Smart Money Moves to Build Long-Term Wealth

Everyone wants to build wealth for the future, but many believe that this is unattainable. You should know that there are a few smart money strategies you can start using that will help you start building towards a brighter financial future. Wealth-building can be achieved with discipline, knowledge, and a long-term mindset, regardless of starting income. Read on to find out more.

Mastering the Basics: Budgeting, Saving, & Avoiding Debt

First, you need to master foundational finance strategies that will help improve your financial well-being and set the stage for investing. This involves creating a monthly budget that helps you control spending, setting money aside into savings each month, and avoiding debt where possible. With these three areas, you can start to build towards a brighter future.

Why Investing Early Pays Off

Many people think that investing is only for those who are already rich, but the truth is that it can be a ladder towards wealth, particularly when you start early. Even investing a small amount each month can lead to large sums over the years, thanks to compound interest – interest accumulated from a principal sum and previously accumulated interest (a snowball effect). Albert Einstein once called compound interest the “eighth wonder of the world” thanks to the exponential growth potential.

Diversifying Your Investment Portfolio

Investing is a powerful way to build wealth, but there are risks involved. This is why diversification is so important – it allows you to spread risk and maximize reward over the long term. Diversification means not having “all your eggs in one basket”, so you want an investment portfolio of different assets, such as stocks, bonds, funds, and real estate. Wealth investment and management specialists can help create a portfolio that suits your investment goals and risk appetite.

Staying the Course: Long-Term Strategies for Success

The key to success with investing is consistency. It can be hard not to check every day and panic when you see turbulence in the markets (which has been common the last few years!), but you need to zoom out and take a long-term approach. Keep investing each month, avoid emotional decision-making, review your goals annually, and adjust your portfolio accordingly (such as reducing exposure to volatile assets as you approach retirement).

These are the strategies that can help you build wealth and create a brighter financial future for yourself. You can start using these strategies no matter your current income and, with consistent effort over the long term, you will see your financial situation change over the years.

-

World1 week ago

World1 week agoEthiopian volcano erupts for first time in thousands of years

-

Health2 days ago

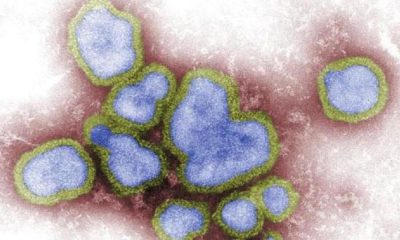

Health2 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

Legal7 days ago

Legal7 days agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News6 days ago

US News6 days agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health7 days ago

Health7 days agoMexico’s September human bird flu case confirmed as H5N2

-

Legal3 days ago

Legal3 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

World7 days ago

World7 days agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast

-

Health6 days ago

Health6 days agoMarburg outbreak in Ethiopia rises to 12 cases and 8 deaths