Reviews

Best Small Business Bank Account: How to Choose the Right Fit for Your Company

When it comes to starting your small business, one of the biggest decisions you’ll need to make is about how to keep your money safe and where to store it. A knowledgeable financial partner can help provide more than a simple place to hold and exchange your money — they can offer the right products, tools, and support to help you achieve more for your business. Whether you’re a brand-new entrepreneur or looking to take your business’s financial setup to the next level, choosing the best small business bank account can make all the difference.

Why Your Business Bank Account Matters

On the surface, signing up for a business bank account may seem like a piecemeal detail — an extra line item to keep your personal and professional finances in check. But in reality, the bank account you sign onto paints a bigger picture of how you handle your company’s bottom line. Tax preparation ease, appearance of credibility to clients and investors — the perks extend far beyond convenience.

More importantly, a quality business bank account will hopefully save you both money and time in the process. Low-to-no monthly fees, quality digital banking options, mobile check deposits, and effective software integration will, quite frankly, positively affect your ability to run. Bluevine, for example, has been a bank name you’ve likely heard in this space; they’ve perfectly tailored bank accounts to entrepreneurial types who are looking for a modern, digital approach.

Key Features to Look for in the Best Small Business Bank Account

While all of the very best small business bank accounts share many common traits, there are some areas where some banks tend to be stronger than others. As you explore banking options, there are a few criteria to keep in mind:

- Low or Affordable Fees: Often, you’ll face monthly maintenance fees, per-transaction fees, and you may even get hit with fees for falling below a minimum balance requirement. Your small business bank account should come with the visibility you need to comply with these requirements, helping you to avoid compliance issues and to safely forecast various expenses.

- Digital Integration: You’re always at your business. Why shouldn’t your bank be there, too? Features like bill pay, on-the-go expense tracking, and immediate alerts just aren’t that innovative anymore. They’re now essentially table-stakes.

- Accounting Software Integration: Banks that connect with QuickBooks, Xero, and other platforms save you tons of time.

- Credit & Loan Offerings: You might think you don’t need a bank account with attractive lines of credit, overdraft protection, and small business loan options. However, having these in your back pocket can be a total lifesaver in the event of an unexpected slump in profits, say.

- Excellent Customer Service: Small businesses can’t afford long wait times when issues arise. A responsive, knowledgeable support team is a must.

Traditional Banks vs. Online-First Banks

The banking world has changed pretty considerably in the last few years. Traditional banks have always delivered peace of mind with their well-established institutions, wide ATM range, and brick-and-mortar customer service. However, as some small businesses are beginning to discover, online-first banks can also pack quite a few punches.

Digital-first banks often offer higher interest rates in their deposits, but lower fees, and a streamlined business platform made with time-strapped entrepreneurs in mind. One of the names that’s been in the news of late has been Bluevine. Like others, this banking provider has slowly become a popular bank for small businesses with high-yield small business checking accounts, sporting newer or less traditional features that cater to the lean owner-operated business.

How the Right Account Supports Growth

The best small business bank account isn’t just about storing funds — it’s about setting your company up for sustainable growth. Consider these real-world advantages:

- Simplified Taxes: With a dedicated account, tax time is far less stressful. You’ll have clear records of income and expenses, making filing more accurate and faster.

- Professional Credibility: Vendors, clients, and even potential investors take a business more seriously when transactions go through a professional account.

- Better Cash Flow Management: Features like invoicing tools, integrated payment systems, and overdraft protection can help small businesses avoid cash flow crises.

- Access to Opportunities: Some banks offer exclusive perks like higher transaction limits, free wire transfers, or cashback rewards that directly contribute to cost savings.

Choosing the Best Fit for Your Business

It might not seem like a big deal, but a bank account is an essential element in an entrepreneur’s overall financial profile. A good partner offers transparency, a range of services, and options to make doing business as seamless as possible. Whether you decide to go with a traditional account or one of the new wave of online-first options, the best small business checking account is one that complements your company operations, objectives, and growth trajectory.

By doing your homework, you’ll ensure that the company’s financial building blocks are as enduring and future-focused as your vision.

-

World1 week ago

World1 week agoEthiopian volcano erupts for first time in thousands of years

-

Health2 days ago

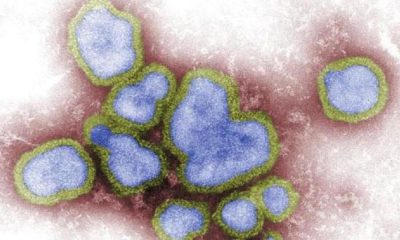

Health2 days ago8 kittens die of H5N1 bird flu in the Netherlands

-

Legal6 days ago

Legal6 days agoUtah Amber Alert: Jessika Francisco abducted by sex offender in Ogden

-

US News6 days ago

US News6 days agoExplosion destroys home in Oakland, Maine; at least 1 injured

-

Health6 days ago

Health6 days agoMexico’s September human bird flu case confirmed as H5N2

-

Legal3 days ago

Legal3 days ago15 people shot, 4 killed, at birthday party in Stockton, California

-

World7 days ago

World7 days agoWoman killed, man seriously injured in shark attack on Australia’s NSW coast

-

Health5 days ago

Health5 days agoMarburg outbreak in Ethiopia rises to 12 cases and 8 deaths