Reviews

New York’s Commercial Casinos Post Steady October Gains, State Data Shows

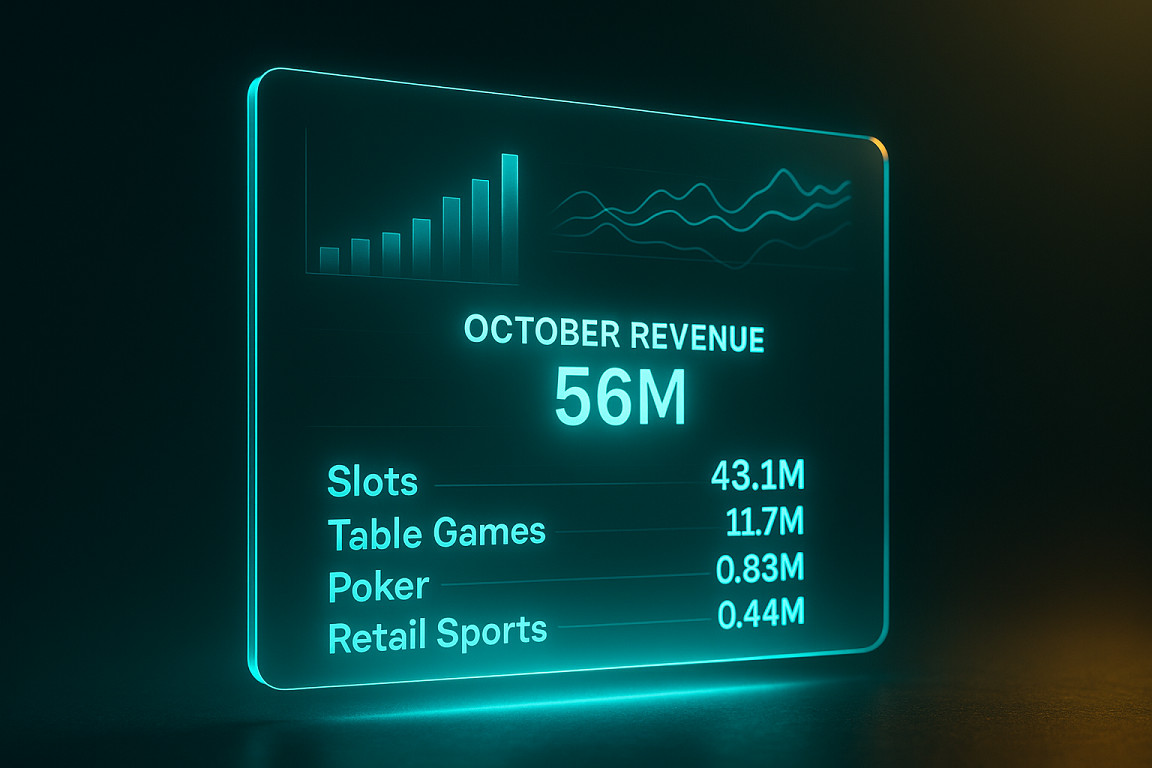

New York’s commercial casinos reported $56 million in revenue this October, a 4.3 percent increase from the same month last year, with the strongest performer posting $17.7 million. The latest figures show that most properties recorded year-over-year gains, supporting the statewide rise as the Gaming Commission released its monthly breakdown of activity.

Within that statewide total, slot machines generated $43.1 million in October, remaining the largest contributor by a wide margin and rising from the $40.2 million recorded a year earlier. Table games moved in the opposite direction, coming in at $11.7 million, down from $12.6 million in October of the previous year. Together, these two segments continue to form the backbone of the commercial casino market, with monthly shifts reflecting how players respond to changing lineups, schedules, and seasonal patterns.

Poker’s share of the month’s results was small, with $831,340 recorded for October. It remains listed as its own category because poker is driven by card odds rather than preset mechanics, which is why tools such as poker odds calculators appear naturally in discussions of how the game works. With the help of similar odds-based tools that shape how lines and probabilities are assessed, retail sports wagering added $438,556 to the monthly total, rounding out the remaining categories listed by the Gaming Commission.

These category shifts sit within a wider pattern, as statewide totals moved between roughly 55 and $ 65 million through the spring and summer months, according to statewide commercial casino reports published by the New York State Gaming Commission. These swings show how the market climbs and settles over the course of the year, even when individual categories rise or soften from one month to the next.

Those monthly movements come from a defined group of venues: full-service commercial casinos in New York are licensed facilities that offer live dealers, table games, slot play, and poker. This is the category that reports daily revenue to the state and undergoes regular oversight to ensure that each type of gaming is tracked separately. It also defines the group of properties included in the state’s monthly commercial casino summaries.

Within that group, the state divides its commercial casinos into four regions, covering the Capital Region, Finger Lakes, Southern Tier, and Catskills. Monthly performance differs from region to region, reflecting local demand, travel patterns, and operating calendars. These variations are common in the state’s commercial casino summaries and serve as a reminder that the statewide total is a composite figure drawn from four distinct markets.

Looked at collectively, those statewide movements also sit within a broader national pattern, with the American Gaming Association’s Commercial Gaming Revenue Tracker showing that commercial gaming revenue through August 2025 reached $51.14 billion, an 8.9 percent year-over-year increase. This wider movement underscores how New York’s results form part of a larger national trend that continued through the summer and into the fall.

National metrics help put local figures in context, but New York’s reporting process is driven by state law rather than by comparisons with other markets. The system requires monthly deposits, and Section 1352 of the Racing, Pari Mutuel Wagering and Breeding Law, governing commercial casino revenues, confirms that the commission may also request a monthly report and reconciliation statement. That requirement supports the Gaming Commission’s practice of issuing monthly revenue updates, with November figures set to be released next as part of the state’s regular public reporting cycle.

-

Health1 week ago

Health1 week agoFrance confirms 2 MERS coronavirus cases in returning travelers

-

Health1 week ago

Health1 week ago8 kittens die of H5N1 bird flu in the Netherlands

-

US News5 days ago

US News5 days agoMagnitude 7.0 earthquake strikes near Alaska–Canada border

-

Entertainment1 week ago

Entertainment1 week agoJoey Valence & Brae criticize DHS over unauthorized use of their music

-

US News1 week ago

US News1 week agoFire breaks out at Raleigh Convention Center in North Carolina

-

Legal6 days ago

Legal6 days agoWoman detained after firing gun outside Los Angeles County Museum of Art

-

Legal2 days ago

Legal2 days agoShooting at Kentucky State University leaves 1 dead and another critically injured

-

Health1 week ago

Health1 week agoEthiopia reports new case in Marburg virus outbreak