Reviews

Simplifying Mortgages and Loans for New Homebuyers: Tools to Make Your Journey Easier

Buying a new home is a thrilling milestone but can also feel overwhelming, especially when navigating the world of mortgages and loans. Understanding your options, budgeting effectively, and utilizing helpful tools can make the process smoother and more manageable. Here’s a breakdown of essential insights and resources every new homebuyer should consider.

Understanding Mortgages and Loans

Mortgages Explained

A mortgage is essentially a loan specifically designed for purchasing property. It allows buyers to secure a home without paying the entire amount upfront. The loan is repaid over time, typically in monthly installments, which include the principal (the original loan amount) and interest (the cost of borrowing).

Types of Loans to Consider

- Conventional Loans: These are not insured or guaranteed by the government and often require higher credit scores.

- FHA Loans: Backed by the Federal Housing Administration, these are popular among first-time buyers for their lower down payment requirements.

- VA Loans: Exclusive to veterans and active military members, these loans often have favorable terms.

- USDA Loans: Aimed at buyers in rural areas, these can provide zero down payment options for those who qualify.

Each loan type has distinct requirements, benefits, and drawbacks. Consulting a lender can help you find the best fit for your financial situation.

Tools to Simplify the Process

Mortgage Calculators

A mortgage calculator is an invaluable tool for estimating your monthly payments and understanding how factors like interest rates, loan terms, and down payments affect your finances. By entering details such as home price, down payment amount, and loan term, you can quickly see how affordable a property is.

Credit Score Checkers

Your credit score plays a crucial role in determining your eligibility for loans and the interest rate you’ll be offered. Tools like free credit score checkers can give you insight into where you stand and help you improve your score before applying for a mortgage.

Budgeting Apps

Apps like Mint or YNAB (You Need A Budget) help you track your income, expenses, and savings goals. They’re perfect for staying on top of your finances while preparing for a significant purchase.

Loan Comparison Platforms

Online platforms allow you to compare interest rates, loan terms, and lender reviews, ensuring you secure the best deal possible.

Key Steps for New Homebuyers

- Determine Your Budget

Use tools like a mortgage calculator to set realistic expectations for what you can afford. Don’t forget to factor in property taxes, insurance, and maintenance costs. - Save for a Down Payment

While some loans require as little as 3% down, larger down payments can reduce your monthly costs and potentially lower your interest rate. - Get Pre-Approved

Pre-approval not only gives you a clear picture of your borrowing capacity but also shows sellers that you’re a serious buyer. - Choose the Right Loan

Research the loan types mentioned above and consult with lenders to find the one that aligns with your needs. - Close the Deal

Once your loan is approved, the final steps include signing the paperwork, paying closing costs, and receiving the keys to your new home.

Overcoming Common Challenges

New homebuyers often face challenges such as understanding complex mortgage terms, deciding between fixed-rate and adjustable-rate loans, and managing unexpected costs. Education is your best ally. Resources like homebuyer workshops, online financial courses, and consultations with mortgage advisors can empower you to make informed decisions.

Final Thoughts

Buying a home is a significant investment, but with the right tools and knowledge, it doesn’t have to be daunting. From leveraging mortgage calculators to exploring various loan options, you can navigate the process with confidence. Start by researching and preparing, and soon you’ll be unlocking the door to your dream home.

Whether you’re dreaming of a cozy starter home or planning for your forever residence, these steps and tools can pave the way to homeownership success.

-

Legal6 days ago

Legal6 days agoMichigan man JD Vance sentenced to 2 years for threatening Trump and JD Vance

-

Politics1 week ago

Politics1 week agoU.S. to designate Maduro-linked Cartel de los Soles as terrorist organization

-

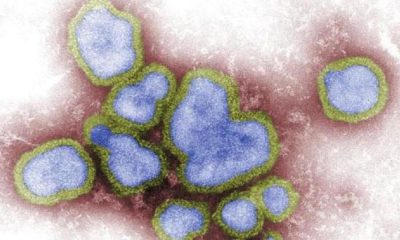

Health7 days ago

Health7 days agoCambodia reports fatal H5N1 bird flu case in 22-year-old man

-

World4 days ago

World4 days agoHurricane Melissa registered 252 mph wind gust, breaking global record

-

Legal4 days ago

Legal4 days agoWoman in critical condition after being set on fire on Chicago train

-

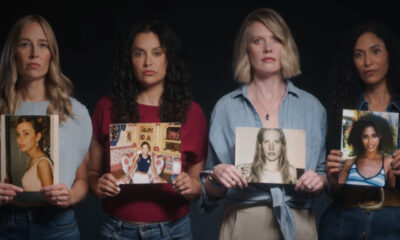

Politics7 days ago

Politics7 days agoEpstein survivors release PSA calling on Congress to release all files

-

Legal4 days ago

Legal4 days ago1 dead, 2 injured in shooting at Dallas Walmart parking lot

-

Legal3 days ago

Legal3 days agoSuspect in San Diego stabbing shot by authorities after fleeing into Mexico